Turn Every Call Into Revenue with a Financial Call Center

Deliver personalized and compliant financial services while managing high call volumes and ensuring regulatory compliance. CloudTalk’s financial call center software provides the essential tools you need to keep customer trust, meet strict security requirements, and drive business growth.

-

Handle peak trading hours and market shifts with intelligent call routing

-

Serve clients 24/7 with AI-powered financial assistance

-

Ensure regulatory compliance with secure, encrypted communications

Hello! Fill out the form; it only takes a minute.

Over 4,000 businesses use CloudTalk to have MORE and BETTER calls

81.7%

Increase of call volume

Call volume got 81.7%↑, missed calls got 23.7%↓.

2.5X

Outbound success rate

Doubled their outbound success & halved lost deals.

80%

Decrease in wait time

Wait times cut by 80% and call handling time by 25%.

Why Your Financial Institution Needs a Call Center

85% Faster Query Resolution

Handle complex financial inquiries efficiently. CloudTalk’s intelligent routing and CRM integration ensure agents have instant access to customer portfolios, transaction history, and compliance requirements for faster resolution.

100% Uptime & Security

Never miss a critical financial inquiry. CloudTalk ensures every call is answered around the clock with enterprise-grade security, encrypted communications, and disaster recovery capabilities built for financial institutions.

81% More Calls Handled

Sync CloudTalk with your core banking systems to give agents instant access to account information, transaction history, and regulatory documentation for personalized service every time.

HOW WE HELP

Advanced Tools for Financial Excellence

Why Top Financial Institutions Choose CloudTalk?

CloudTalk is the call center system that actually understands how financial services work.

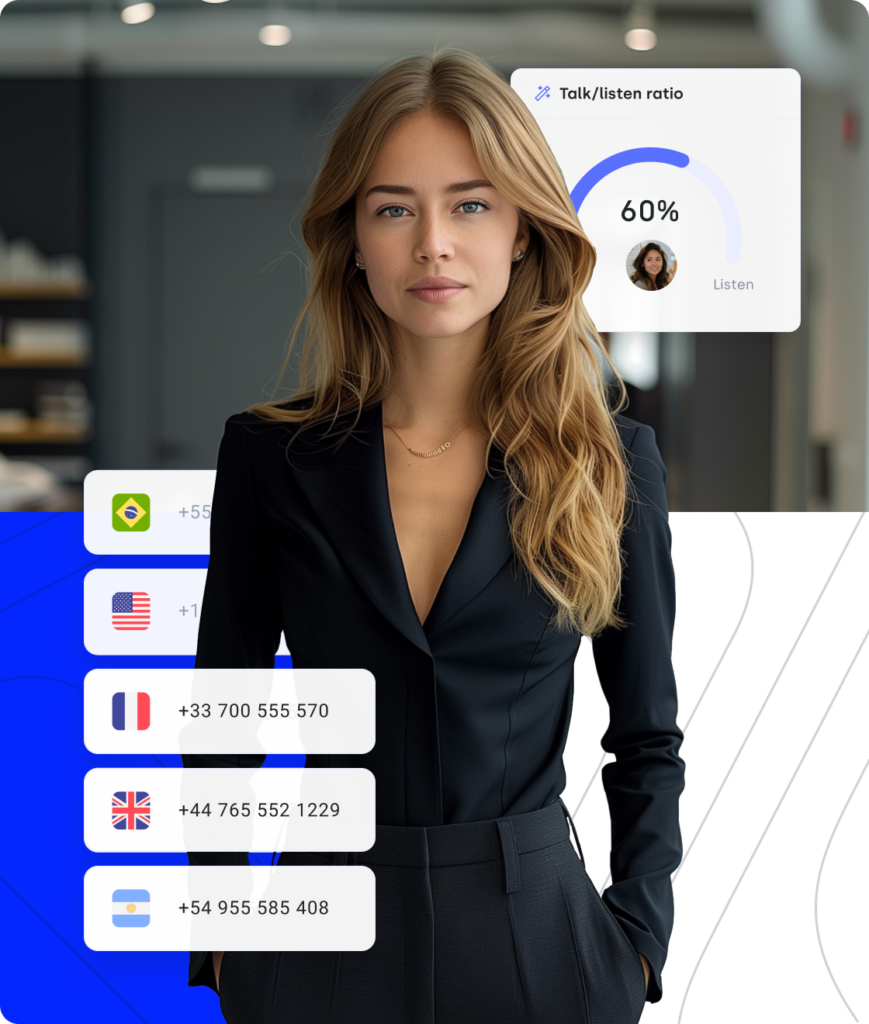

CONNECT FASTER, SERVE BETTER

Convert More Inquiries Into Accounts With Smart Call Handling

Stop losing opportunities to busy signals. While other financial institutions miss calls during market volatility or let international clients struggle with language barriers, CloudTalk ensures you’re always available with the right expertise.

No more “please call back during business hours” when today’s inquiry becomes tomorrow’s competitor’s client.

CloudTalk manages your entire client communication journey, turning initial inquiries into confirmed accounts, service requests into satisfied clients, and conversations into loyal customers.

Secure Financial Communication

Intelligent Routing That Maximizes Every Opportunity

CloudTalk’s advanced routing technology ensures every client inquiry reaches the right financial expert immediately. CloudTalk’s skill-based routing and IVR system allows you to direct calls based on expertise, client value, and inquiry type for optimal outcomes.

While you’re handling account openings, CloudTalk’s system intelligently connects urgent fraud reports to security teams, routes investment inquiries to certified wealth advisors, and directs VIP clients to dedicated relationship managers around the clock.

Abroad call never been easier, feels super comfortable because the rates are super affordable and the service is top-notch.

24/7 Financial Service Advantage

Security and Compliance Focus That Builds Trust

CloudTalk’s 256-bit encryption and ISO 27001 certification ensure every client conversation meets financial industry security standards. CloudTalk’s platform logs interactions for regulatory compliance while protecting sensitive financial data with role-based access controls.

CloudTalk’s SOC 2 audits and GDPR compliance features provide additional layers of protection for banking communications. Multi-factor authentication and secure data storage ensure client information remains protected every time.

Very easy and quick set up, perfect call quality even with overseas customers and the most important thing – very useful customer support ready to help and solve any issues.

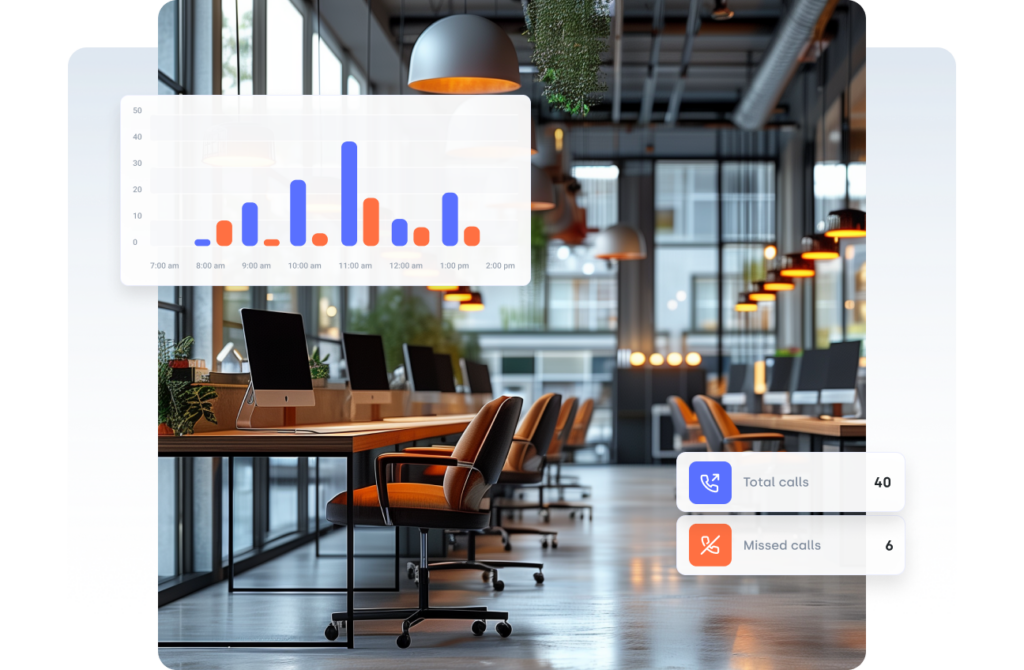

Data-Driven Financial Excellence

Client Service Analytics That Drive Satisfaction

Transform client feedback into guaranteed improvements. CloudTalk tracks the metrics that matter: response times, resolution rates, client satisfaction scores, and peak service hours.

See which communication strategies are building client loyalty and focus on the approaches that consistently deliver exceptional financial experiences.

Great constantly evolving tool. This tool helps us seamlessly maintain contact with our customers around the globe. Essential for our line of work.

How to Set Up Your Financial Call Center in 5 Steps

Simple setup that gets you serving clients today, no technical expertise needed.

Step 1: Choose Your Global Numbers: Select local and toll-free numbers for your key markets.

Step 2: Set Up Your Team: Add advisors, assign departments, and create schedules with role-based permissions.

Step 3: Connect Your Systems: Link your core banking system, CRM, or trading platform.

Step 4: Configure Client Journeys: Set up call flows using drag-and-drop.

Step 5: Go Live: Start serving clients and optimize everything from one secure dashboard.

Get the Best Value on Financial Call Center Software

FAQs

What is a financial call center?

A specialized communication hub for financial services that handles client inquiries, transactions, and compliance requirements.

What are the types of financial call centers?

Account servicing, loan processing, investment advisory, fraud prevention, and regulatory compliance centers.

How does a financial call center work?

Agents use secure software to handle calls, process transactions, and maintain regulatory compliance with real-time documentation.

What is the best virtual receptionist for Finance?

CloudTalk’s AI voice agents provide 24/7 support with bank-grade security and compliance features for financial institutions.

What is the best call center software for Finance?

CloudTalk offers specialized financial services software with regulatory compliance, encryption, and banking integrations.

How much does Finance call center software cost?

Pricing starts at $19 per user, with custom enterprise pricing available for larger financial institutions and additional compliance features.

How to outsource a Finance call center?

Choose a compliant provider with financial industry experience, security certifications, and regulatory expertise.

CloudTalk is built to simplify calling operations with reliable AI business calling

Schedule a demo today to see how CloudTalk can support your teams.