IVR in Insurance: How IVR Powers Insurance Growth

Why is IVR Crucial for Insurance Companies?

Insurance call centers handle a constant stream of repetitive, time-sensitive, and regulated calls. Without automation, teams stay stuck in reactive mode. Agents waste time on basic questions, while more urgent issues get delayed.

IVR automates routine tasks, reduces manual effort, and routes calls efficiently—freeing up agents for higher-value conversations. This leads to faster resolutions, fewer missed calls, and better HIPAA compliance tracking.

It also enables 24/7 service, which is critical when customers need to file claims or check policies outside business hours.

Learn more about IVR in our video guide below:

A well-built IVR doesn’t just answer calls. By letting customers resolve simple issues instantly and reach the right team for complex ones, it lowers frustration, speeds up resolution, and opens the door to contextual upsells. This is especially crucial considering 81% of consumers want more self-service options.

TL;DR

-

01

IVR creates a structured, trackable workflow that improves regulatory compliance and customer trust.

-

02

Smart IVR supports real-time decision-making in critical use cases like fraud detection and claims triage.

-

03

With CloudTalk, insurers can build custom IVR workflows, integrate with CRMs, and use call analytics to surface upsell signals and automate renewals at scale.

Build smarter IVR workflows

Key Use Cases of IVR in Insurance

Maya’s team is still overwhelmed by routine policy questions. Daniel’s struggling to keep up with high-risk claim reviews. They both need a better way of handling calls. IVR gives both leaders a way to triage, prioritize, and resolve issues faster—without hiring more agents.

Below are key IVR use cases that help insurance teams operate more efficiently while delivering better service at scale.

1. Automates Policy Inquiries and Renewals

Customers don’t want to wait on hold to get basic information. Smart IVR lets them check their policy status, confirm renewal dates, and make changes to their own schedule.

For example, a regional health insurance provider might use IVR to handle peak-season policy renewals. Customers can confirm their renewal, update contact details, and request documents in under two minutes—without ever speaking to a live agent. This leads to cutting call volume by 40% during open enrollment.

2. Streamlines Claim Reporting and Processing

Filing a claim can be stressful. IVR systems guide policyholders step by step through the reporting process, collect the necessary information, and log it directly into the CRM.

A property insurance company, for instance, might use IVR to handle storm damage claims. When a major weather event hits, affected policyholders can call in, report the incident through a guided IVR flow, and receive a claim number via SMS—all without waiting for agent availability. The system also triggers internal alerts for high-severity cases so adjusters can prioritize them.

3. Fraud Detection and Risk Mitigation

Daniel’s fraud team begins using voice authentication and AI to detect inconsistencies in high-risk calls. IVR screens for anomalies, flags repeat callers with suspicious patterns and routes them directly to the fraud team.

A life insurance provider might also use this setup during beneficiary changes. If a caller requests a change and fails voice authentication or triggers a pattern match with previous flagged behavior, IVR escalates the call before any action is taken—reducing fraudulent payouts and tightening security controls.

4. Reduces Agent Workload with Self-Service Options

Simple tasks like making payments, updating addresses, or requesting policy documents don’t need human intervention. IVR handles them instantly, reducing queue times and agent burnout.

For example, a car insurance company can roll out voice-enabled IVR for monthly premium payments. Customers call in, verify their identity through voice recognition, and complete secure transactions in seconds. This clears the heavy load of repetitive payment-related calls from live agent queues.

5. Personalizes Upselling and Cross-Selling

The best IVR software goes beyond support. It can also recommend relevant products based on a customer’s profile and behavior.

For example, after a travel insurance customer completes a claim for a canceled trip, the IVR system offers an upgrade to a premium plan that includes weather disruption coverage. The recommendation is based on their recent travel history and claim type, creating a relevant upsell opportunity without relying on a sales rep.

AI-enhanced IVR can analyze policy history, engagement patterns, and demographics to deliver the right product message at the right time—automatically.

Best Practices for Implementing IVR in Insurance

Maya’s team finally has fewer repetitive calls, but she’s still hearing complaints about confusing menu trees. Daniel’s team gets better fraud alerts, but the data isn’t syncing cleanly with their CRM. The takeaway? Rolling out IVR is only step one. How you structure it, connect it, and optimize it over time makes the real difference.

Below are the best practices for designing an IVR system that doesn’t just function—but actually drives results.

Design a Customer-Friendly IVR Menu

Avoid long, nested menus that frustrate callers. Keep the structure simple, with no more than 3 to 4 options per level. Use natural language IVR where possible so callers can say what they need instead of memorizing numbers.

For example, a health insurer might redesign its IVR to use voice prompts like “I want to renew my policy” or “I need to report a claim” to significantly reduce call abandonment.

How to apply it:

Audit your current menu structure. Identify where customers are dropping off or looping back, and shorten or rephrase prompts accordingly. Consider testing a voice-activated IVR option for your most common call types.

Real-Life Example

Pro tip: Use Skill-Based Routing to back up your IVR menus. Once a caller makes a selection, they’re automatically directed to the best-fit agent based on expertise, not just availability. This improves resolution speed and boosts customer experience without adding more steps to the call flow.

Integrate IVR with CRM and AI Analytics

Disconnected systems create more work. When IVR is integrated with your CRM, every interaction is logged automatically—giving agents full context when live transfers happen. AI analytics add another layer, helping identify trends, issues, or opportunities.

Maya’s team, for instance, connects CloudTalk to their policy management CRM. Now, when a customer calls to renew, IVR pulls up policy data in a dashboard, confirms eligibility, and pushes updates back to the system. No manual entry required.

Before we continue, check out the video below for more on AI in insurance:

How to apply it:

Work with your CRM admin to map key data fields between your IVR and CRM. Identify the top 3 workflows—like renewals, claims, or payments—that need syncing. Then use a platform like CloudTalk to automate the handoff.

Offer an Easy Opt-Out to Live Agents

Not every customer wants self-service. Make sure every IVR menu clearly gives the option to speak with a human—without forcing the caller through multiple hoops.

Daniel learned this the hard way when an angry policyholder couldn’t get past the automated fraud check. His team updated the flow to offer a live transfer option early in the call path, reducing escalations and improving satisfaction scores.

How to apply it:

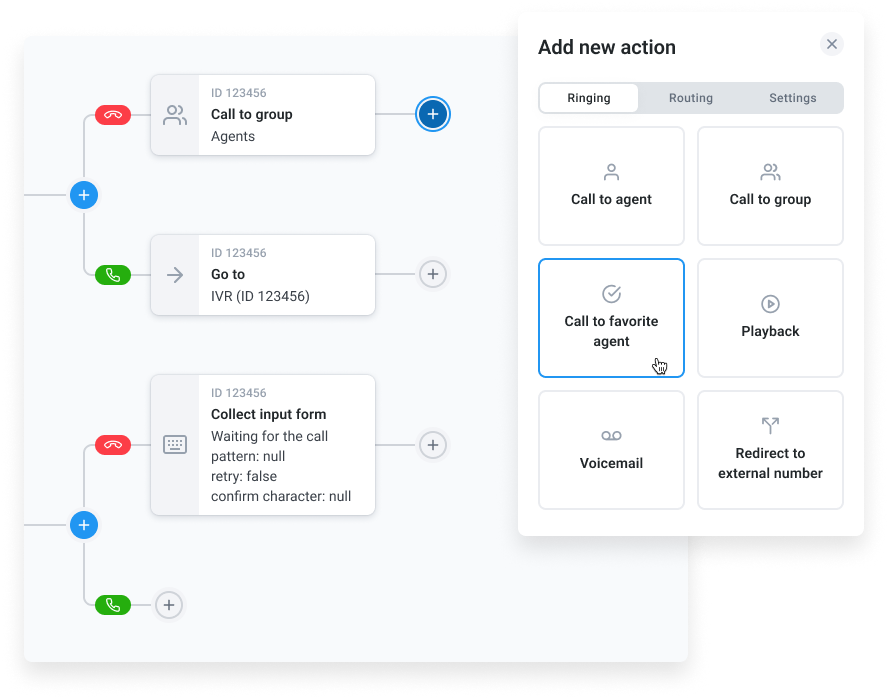

Review your call flows and flag where customers might get stuck. With CloudTalk’s Call Flow Designer, it’s easy to create your own customer journey without any coding. Simply add a “press 0 to speak with an agent” option at the first or second level of the menu. Then, monitor transfer rates to ensure the path is working as expected.

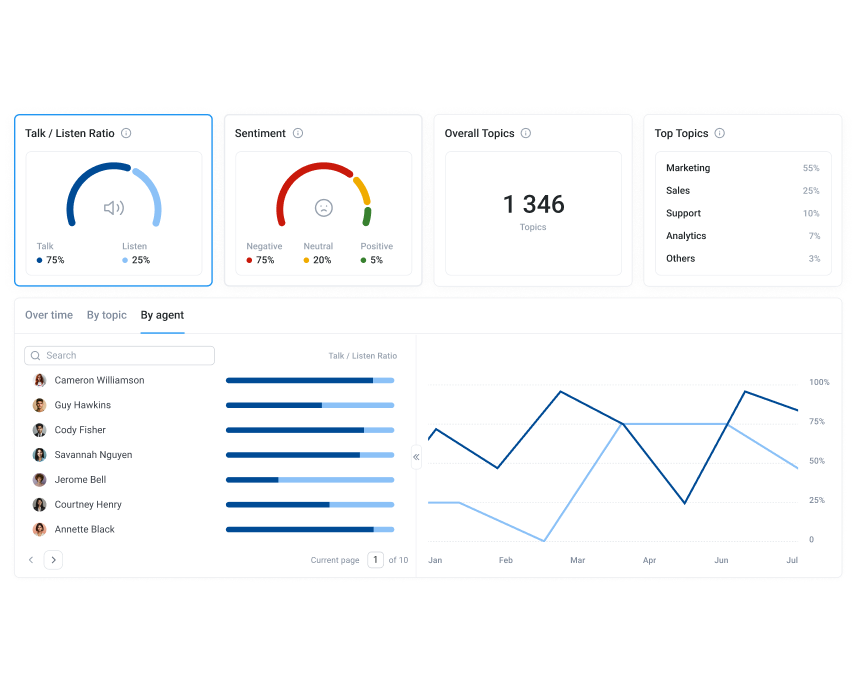

Continuously Refine IVR Workflows with Data Insights

What works now won’t always work later. Regularly review IVR performance metrics like call containment rate, average resolution time, and abandonment rate. Use real-time feedback and Sentiment Analysis to update scripts, flag issues, and improve routing logic. This lets you adapt quickly to changing customer needs and resolve friction points before they impact satisfaction.

For example, a national insurer notices a spike in call drops during the claim submission process. After reviewing call transcripts and abandonment patterns, they simplify the IVR steps and add a confirmation SMS—resulting in a significant improvement in completion rates.

How to apply it:

Set a monthly or quarterly IVR review cadence. Pull reports on call outcomes, survey responses, and call lengths. Use this data to prioritize updates to your call scripts or routing logic. CloudTalk users can start with the Call Analytics dashboard.

Reduce Costs by 30% with IVR

Even small improvements to your IVR can make a big difference. Handling just 5–20% more calls automatically can cut call center costs by 10–30%. From cutting down on routine admin to catching fraud signals earlier, high-performing IVR systems make every customer interaction more relevant.

IVR handles the repetitive work, so agents can focus on complex requests that actually need human input. With voice authentication and anomaly detection built into the call flow, suspicious activity gets flagged and escalated before it causes damage.

With CloudTalk, insurance teams can design IVR systems that do more than deflect calls. You can automate policy updates, streamline claims, detect fraud, and personalize product offers—all while giving customers faster, more reliable service.

Build smarter IVR workflows

Sources: