The 2025 Playbook for Conversational AI in Banking

Most banking conversations today still feel like they’re stuck in 2005. Press 1 for this, press 2 for that, wait on hold, repeat yourself, get transferred. Want to set your financial institution apart? Then look for up-to-date technology solutions.

While banking systems are using obsolete systems, customers are using voice assistants, messaging apps, and instant support everywhere else in their lives. Expectations have shifted. Fast, personalized, human-like conversations are now the baseline.

That’s where conversational AI comes in.

Conversational AI is technology that enables natural, two-way interactions between people and machines through voice, chat, or both. But in banking, it’s so much more than that. It’s the layer that’s quietly transforming how financial institutions engage customers, verify identities, detect fraud, and streamline operations.

Today, AI-driven voice and chat agents handle balance inquiries, loan prequalifications, and even KYC onboarding with a level of speed and consistency that human teams alone can’t match. On the compliance side, these tools help flag risky language or missed disclosures before they become audit problems.

In this article, we’ll explore how conversational AI is reshaping banking, use case by use case, and why now is the time to make your move.

Key takeaways:

- Conversational AI enables 24/7, human-like support across voice and chat, improving customer satisfaction and reducing wait times.

- Banks use AI to streamline onboarding, loan qualification, and fraud alerts, cutting manual workload and boosting efficiency.

- Compliance is enforced in real-time, with AI detecting missed disclosures or risky language during live or post-call reviews.

- Conversational AI platforms like CloudTalk drive measurable ROI, lowering operational costs while increasing service speed and quality.

Automate call insights for better coaching and happier clients.

What Is Conversational AI in Banking?

Conversational AI refers to the use of technologies like natural language processing (NLP), machine learning, and voice recognition to simulate human-like interactions.

In a banking context, that means customers can check balances, update account details, ask for loan options, or get help with a declined card, anytime, anywhere, through natural conversation. This is where it differs from traditional chatbots in banking or IVR systems.

Standard bots follow rigid scripts and fail when the customer steps slightly off-path. IVRs force people to “press 1” or repeat themselves endlessly. Conversational AI, on the other hand, understands intent, learns from context, and adapts mid-conversation.For example, someone might say, “I’m looking to move some money into a short-term investment—what do you recommend?” That’s not a simple yes/no question. Conversational AI can identify the financial goal, assess risk preferences, and surface suitable options—all while staying compliant.

The backbone of this shift includes:

- Natural Language Processing (NLP): Understands and processes human language, both written and spoken.

- Machine Learning: Continuously improves accuracy by learning from past interactions.

- Voice AI: Enables intelligent voice conversations that feel less robotic, more intuitive.

Combined, these technologies power smarter, more secure conversations. Then, you’ll have unlocked new ways to serve customers without adding headcount.

7 Powerful Use Cases of Conversational AI in Banking

Conversational AI isn’t replacing bankers. It’s replacing outdated systems that frustrate both customers and employees.

Let’s break down where AI is delivering the most impact right now.

Voice AI for Banking Call Centers

Your frontline teams spend a huge chunk of time on basic Tier 1 queries including PIN resets, account balance checks, routing numbers. Voice AI takes those off their plate entirely.

These intelligent agents don’t just respond. They carefully listen to detect sentiment in real time, know when to escalate to a human, and can manage large call volumes without compromising service.

This has a massive ripple effect: shorter wait times, faster resolutions, and less burnout on your human agents.

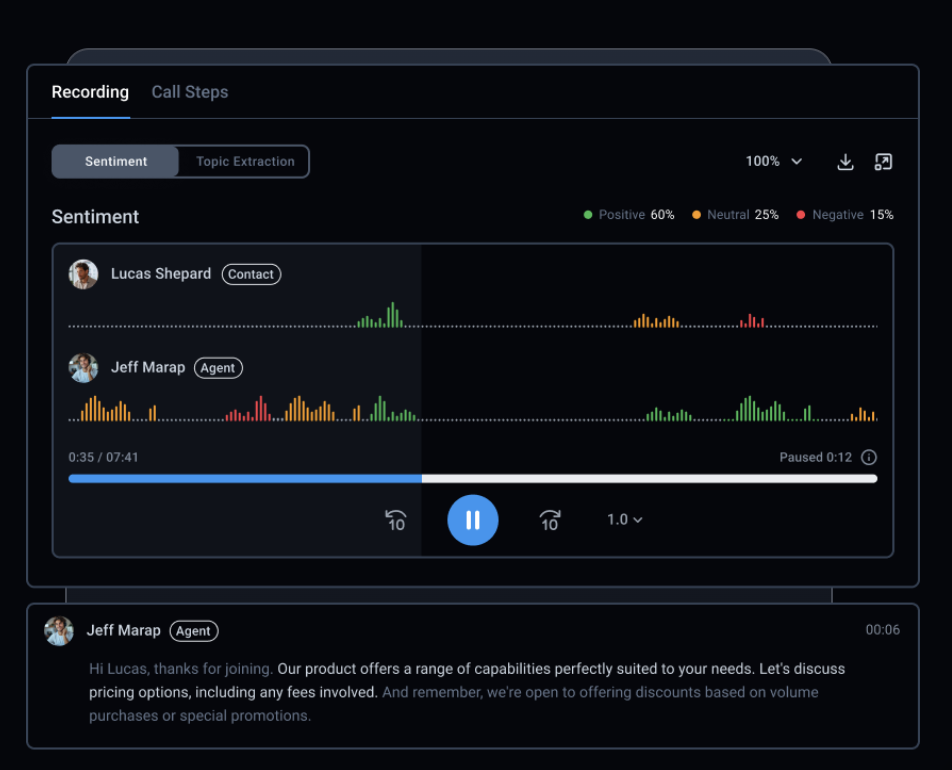

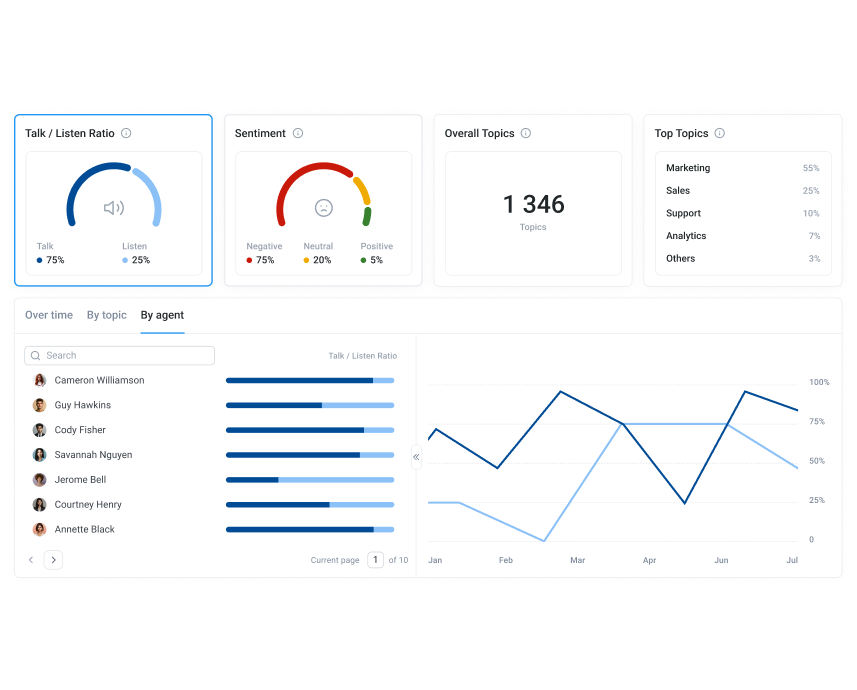

Tools like CloudTalk’s talk/listen ratio and voice transcription give you actionable insights into every conversation. This means you can turn your support into a strategic function.

AI-Powered Loan Prequalification Conversations

Applying for a loan shouldn’t feel like doing your taxes.

With conversational AI, banks can guide customers through prequalification via real-time chat or voice. Instead of downloading PDFs or struggling through mobile forms, users simply answer natural questions:

“What’s your income range?”

“Are you employed full-time?”

“How much are you looking to borrow?”

AI processes the answers instantly, identifies whether the applicant is a match, and nudges them further down the funnel, all with minimal friction.

The result is fewer abandoned applications, higher conversion rates, and broader accessibility for people who might otherwise opt out. This is conversational ai for banking at its most practical.

Reduce average call duration by as much as 40%

Conversational KYC and Onboarding Automation

Traditional onboarding is slow, manual, and filled with compliance landmines.

Conversational AI fixes that. Customers can submit ID documents, confirm personal info, and walk through regulatory disclosures in a chat-style experience that feels familiar and low-pressure.

AI ensures that nothing is skipped. Every required script is delivered, every box checked. It can even switch languages on the fly, making global onboarding seamless.

According to stats, AI reduces average KYC processing time by 90%*. Studies like this show that modern banks can’t afford to keep treating onboarding like paperwork. It’s a conversation.

Real-Time Compliance Monitoring in Client Calls

Conversational AI listens for regulatory gaps in live or recorded calls. Did the agent explain risk disclosures before recommending a financial product? Did they skip mandatory language around fees?

AI flags these issues automatically before they escalate into fines, investigations, or lost licenses. CloudTalk’s auto-call summaries and tagging systems turn compliance from a reactive process into a real-time capability.

Automated Payment Support via Conversational Flows

When customers miss a payment or need to renegotiate terms, conversational AI gives them instant access to support. 24/7 help for payment extensions, explanations of interest charges, and upcoming billing all without waiting in line. Comprehensive banking chatbot solutions extend this support across email, chat, and messaging platforms, ensuring customers can resolve payment issues through their preferred communication method.

When a more complex issue arises, like a disputed charge? AI knows when to hand it off to a human agent with the full context. This use case alone cuts inbound call volume dramatically while freeing up your staff for high-value interactions.

Fraud Warning Conversations That Rebuild Trust

This is where AI earns customer loyalty. Instead of a generic email or cold SMS, imagine this:

“We noticed a charge in Brazil—was this you?” with a one-tap “Yes” or “No” to confirm.

It’s fast. It’s human-like. And it shows up exactly when it’s needed most. Conversational AI makes these interactions less robotic and more reassuring, simply by turning a fraud scare into a trust-building moment.

Here’s what you can do with conversational AI in finance when it’s done right.

Internal Process Automation with Conversational Agents

Banks are using conversational AI behind the scenes, too. Need to file an IT ticket, check HR policies, or confirm an internal process? Conversational agents handle it in seconds.

This kind of internal automation saves thousands of hours each year. Yet it’s one of the most underutilized opportunities in financial services. This is a no-brainer for banks facing rising employee turnover and margin pressure.

Why Conversational AI Is a Game Changer for Banks

Customers can book flights, order groceries, or manage healthcare appointments with just a few words or taps. But when they call their bank, they’re still stuck navigating phone trees, waiting on hold, or repeating themselves across departments.

How should you mend that gap? Do you know how much it is costing you in terms of trust, time, and money?

Here’s why conversational AI is a foundational must-have:

1. Demand for 24/7 Support Has Become Non-Negotiable

Banking doesn’t happen from 9 to 5 anymore. Your customers are paying bills at midnight, applying for loans on weekends, and checking transactions before catching flights.

Conversational AI ensures you’re available when they are. Whether it’s a simple balance check or a fraud alert response, AI keeps the experience moving even while your human agents sleep.

2. Customer Expectations Have Shifted Permanently

Today’s customers want smarter, more personalized interactions. That means less waiting, less repetition, and more context. Conversational AI delivers all of that by remembering previous interactions, tailoring responses, and using natural language, and more.

For example, the AI assistant might learn from the conversations with a customer that this person wants to secure their children’s financial future and is interested in setting up a trust without a lawyer. With this information, they can recommend detailed banking resources or highlight the need for professional advice.

3. Banks Need to Do More With Less

The pressure to cut costs while improving service is real. Hiring more agents isn’t scalable. But AI is. By automating high-volume, low-complexity tasks like password resets, KYC flows, or payment reminders, conversational AI reduces operational overhead without sacrificing quality.

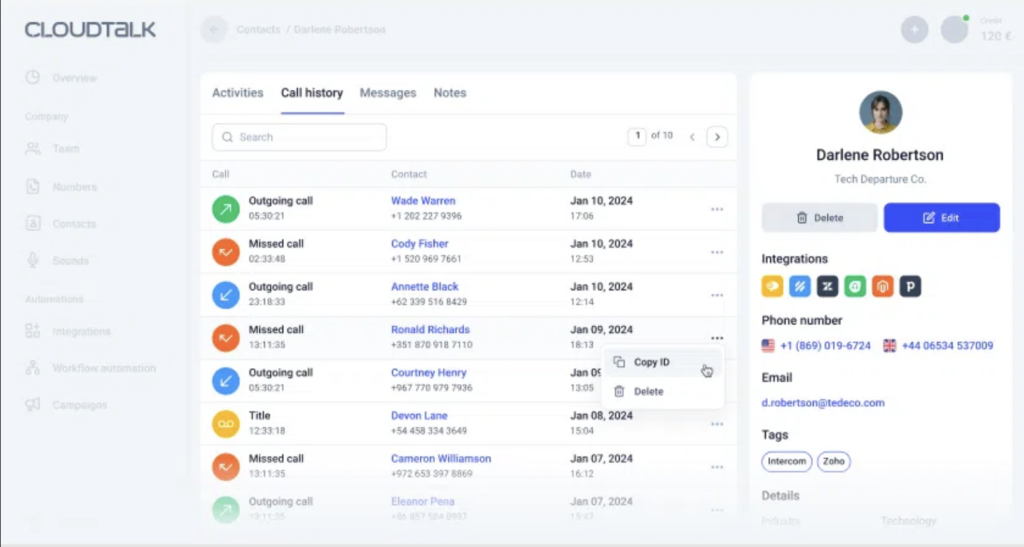

Add in tools like CloudTalk’s AI-powered call summaries or automated tagging, and suddenly your team spends less time writing notes and more time solving actual problems. Here’s an overview of how contact tagging works:

4. Compliance and Risk Teams Benefit, Too

Banks operate in one of the most tightly regulated industries on the planet. Conversational AI helps enforce rules consistently, whether by making sure agents deliver required disclosures or flagging non-compliant phrasing mid-call.

It turns every conversation into a traceable, auditable data point. That’s gold for risk teams—and peace of mind for leadership.

5. Internal Teams Get a Productivity Boost

We often focus on customer-facing benefits, but conversational AI offers workflow advantages internally too. IT tickets, HR questions, and employee training and productivity, all can be handled through smart AI assistants.

Financial institutions tend to overlook this use case, but the payoff is massive. It reduces internal friction and gives employees faster access to the tools and knowledge they need.

Choosing the Right Partner to Deploy Conversational AI in Banking

Implementing conversational AI has two components: buying software and choosing a partner. While the two are connected, they require separate research.

You want a feature-rich solution. However, your provider should also understand the complexity of financial services, compliance demands, and what modern customers actually expect from digital banking.

Here, you can see how CloudTalk’s solutions map to specific use cases, teams, and industries:

Use Case

CloudTalk Solution Area

Key Benefit

Call Center Deployment

IT & Operations

Launch in under an hour

Sales Acceleration

Sales

Reach leads faster, close more deals

Customer Retention via AI

Customer Support

AI-driven support to reduce churn

Cross-Team Operations Streamlining

Company-wide

Advanced features for system-wide impact

Global Outreach for Tech Firms

Software & Tech

AI-enabled global call flowse.

Secure, Compliant Financial Services Support

Financial Services

Protected data + enhanced CX

Market Expansion for Professional Services

Professional Services

Faster outreach and growth

Enrollment Growth in Education

Education & E-learning

Higher enrollment via optimized calling

Remote Team Enablement

Remote Teams

Effective remote ops and agent routing

Business Phone System for Lead Gen

Business Phone System

Boost pipeline efficiency

Salesforce Calling Integration

Calling for Salesforce

Improved sales workflows in Salesforce

HubSpot Calling Integration

Calling for HubSpot

Unified customer context in HubSpot

Micro Business Outreach

Micro Business

Simplified processes, more deals

Small Business CX & Growth

Small Business

Revenue growth + better support

Enterprise Global Expansion

Medium & Large Business

Scalable calling + international presence

From 9–5 Banking to 24/7 Intelligent Conversations

As you finalize your board deck and prepare to make the case for transformation, one thing should be clear: conversational IVR is already redefining how banks deliver service around the clock.

From midnight fraud alerts to early-morning wire transfers, modern customers expect intelligent, on-demand support. And delivering that means moving beyond legacy call flows and rigid menu trees.

CloudTalk helps financial institutions make that leap quickly and securely. With smart routing, AI-powered compliance tools, and omnichannel support built in, our platform is designed for scale, speed, and trust. This isn’t just automation—it’s a better way to bank, one conversation at a time.

Ready to modernize the banking services you offer to your customers?

Source:

FAQs

How do banks choose the right conversational AI vendor?

Banks look for conversational AI in banking platforms with compliance support, voice capabilities, CRM integrations, and financial expertise.

Can conversational AI integrate with core banking systems?

Conversational AI for finance integrates with core banking systems to provide real-time data access, secure workflows, and smart automation.

How much does conversational AI cost for financial institutions?

Conversational AI in financial services is typically priced per user or interaction, with scalable plans based on usage and enterprise needs.

Is voice AI better than chatbots for banking?

Voice AI outperforms banking chatbots in Tier 1 support by enabling natural, real-time interactions and smarter sentiment-driven routing.

What’s the difference between conversational AI and traditional IVR?

Conversational AI in banking uses NLP and machine learning for context-aware responses, unlike IVR systems that rely on static menu options.

How does conversational AI improve call center ROI in finance?

Conversational AI improves call center ROI in finance by automating high-volume queries, lowering handle time, and boosting first-call resolution.