How to optimize customer acquisition costs in the face of economic turbulence

In the face of economic turbulence, businesses are facing a new reality – customers are becoming more hesitant to spend their hard-earned money. With them demanding more value for less money, attracting their attention has become increasingly difficult, resulting in a higher cost per acquisition.

In times like these, SaaS companies need to pay extra attention to their Customer Acquisition Cost (CAC) to ensure long-term profitability and sustainability. CAC is a crucial metric that can make or break a business, and if not managed efficiently, it can become their Achilles Heel.

In this blog post, we’ll explore how to optimize your CAC in the face of economic instability and share practical tips to help your SaaS business survive and thrive. So buckle up, and let’s dive in!

What is the customer acquisition cost (CAC)?

The cost of acquiring a new customer encompasses all expenses incurred by a business in attracting and converting a single customer.

This cost is crucial for the long-term profitability and sustainability of a business, especially for SaaS companies. It involves various marketing and sales expenditures, including advertising charges, remuneration of sales personnel, marketing initiatives, software applications, and any other expenses related to drawing in new customers and enhancing their customer experience.

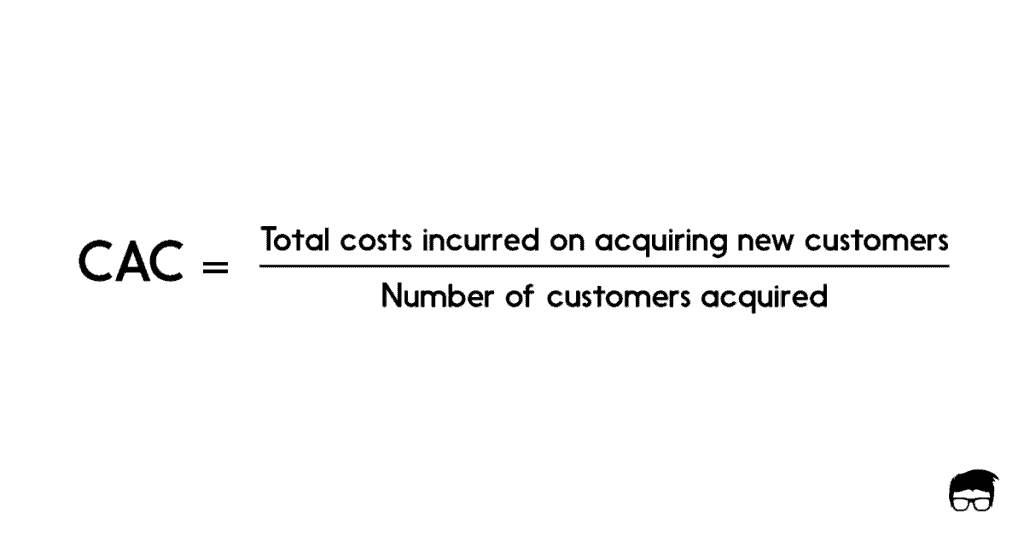

How to calculate customer acquisition cost?

To calculate the Customer Acquisition Cost, first, select a specific time frame for evaluation. Once you determine the evaluation period, you can apply the CAC formula, which involves dividing the Cost of Sales and Marketing by the Number of New Customers Acquired within that period.

For instance, suppose your company’s sales and marketing expenses were $500,000 and $300,000, respectively, during the last fiscal quarter, and 800 new customers were acquired during the same period. In that case, the CAC for the quarter would be $1,000 per customer. Keep in mind that comparing CAC to other business metrics can provide valuable insights into customer service, marketing, and sales campaigns.

Why does customer acquisition cost matter in SaaS?

Customer Acquisition Cost plays a crucial role in identifying the most effective customer acquisition channels and tactics, such as social media, some key points of an SEO checklist, cold calling, and others.

For SaaS companies, it can take a considerable amount of time and money to acquire new customers before seeing a return on investment. Analyzing CAC can help you determine how long it takes for your company to recover costs and turn a profit.

Another important aspect of CAC is identifying high-value customer personas and measuring their price sensitivity. Understanding CAC is critical in determining margins, revenue, and profit as a company scales. By knowing CAC, your company can avoid inefficiencies that could ultimately lead to business failure.

What is a good CAC ratio for SaaS?

Determining the optimal CAC ratio for your company relies on your customer’s lifetime value (LTV). CAC and LTV go hand in hand: while CAC represents the expenses of acquiring a customer, LTV approximates the total value of a customer over time.

For a SaaS company, the LTV:CAC ratio benchmark typically falls around 3:1, with a ratio of 3:1 or higher being desirable to ensure profitability. However, if the ratio goes too high (5:1 or more), it might imply that you’re under-investing in customer acquisition and hindering growth.

What is a CAC payback period?

A CAC payback period is a metric that determines the time needed to recover the cost of acquiring a new customer. If a customer leaves during this period, the business loses money. For your SaaS company, it’s vital to keep customers satisfied and subscribed long enough to generate profit.

A healthy CAC payback period typically ranges from 5 to 12 months. The longer the payback period, the longer it takes to make a customer profitable, so it’s essential to monitor this metric closely.

What To Consider Before You Start Reducing CAC?

When it comes to customer acquisition, minimizing costs is a priority for any business. However, it’s important to remember that CAC has limitations as a metric, and using it as a benchmark requires careful consideration.

Here are some factors to keep in mind to ensure that you’re using CAC effectively:

- Time to Revenue: Be mindful of the time period you’re using to calculate CAC. Setting the time period too short or too long can affect the accuracy of your calculation. It’s crucial to have an up-to-date Time to Revenue metric to ensure you’re calculating CAC accurately.

- Customer Diversity: Not all customers are created equal, and CAC doesn’t take into account the value of individual customers. Cutting certain channels with high CAC may negatively impact revenue, so it’s important to consider Lifetime Value and segment your customer base to optimize customer acquisition costs.

- Growth Mode: Depending on your growth stage, your priorities will differ. If you’re in the early stages of high growth, prioritize demand generation and brand building over profit margins. In contrast, if you’re in “growth mode,” prioritize scalability over cost reduction.

- Data Monitoring: Effective CAC optimization requires good tracking, data from your tech stack, and B2B-specific attribution modeling. Make sure you have the right data and tools in place to make informed decisions about your CAC strategy.

The CAC Optimization Playbook: Learn from 16 Experts in SaaS Industry

To put the knowledge we just share to practice, we prepared tips, tricks, and insights from 16 experts who have successfully navigated the complexities of CAC optimization and achieved remarkable results.

Whether you’re a startup founder, a marketer, or a growth enthusiast, this CAC optimization playbook will equip you with the tools and knowledge you need to optimize customer acquisition costs, drive growth, and ultimately, succeed in the highly competitive SaaS landscape.

1. CloudTalk.io

At CloudTalk, we understand the importance of optimizing your customer acquisition costs to ensure the long-term success and growth of your SaaS business. That’s why we believe in learning from the best in the industry to develop an effective CAC optimization playbook.

One industry expert that we look to for guidance is Lincoln Murphy, a SaaS growth strategist and founder of Sixteen Ventures. Murphy emphasizes the importance of customer success in reducing CAC, stating that the best way to reduce CAC is to “make sure the customer is successful, and they will bring in more customers for you.” This approach aligns with our own philosophy at CloudTalk, where we prioritize customer success and satisfaction above all else.

Another expert that we follow is Neil Patel, a digital marketing guru and founder of Neil Patel Digital. Patel stresses the importance of measuring and analyzing your CAC data to identify areas for improvement. He recommends tracking your CAC by channel and segmenting your customer base to identify which channels are most effective and which segments are most valuable. At CloudTalk, we use data-driven insights to optimize our own CAC and help our clients do the same.

Finally, we turn to David Skok, a venture capitalist and SaaS expert. Skok emphasizes the importance of understanding your customer acquisition funnel and identifying bottlenecks that may be driving up CAC. By optimizing each stage of the funnel, you can reduce CAC and improve overall conversion rates. At CloudTalk, we work with our clients to optimize their customer acquisition funnel and streamline the process for maximum efficiency and effectiveness.

2. HubSpot.com

Thought leader: Tony Do

Position: Marketing Manager, HubSpot

CAC should always be a booster for customer acquisition, never the baseline. A lot of growing brands and companies think that CAC is the best way to grow a business since the turnaround and investment provide quicker gratification. But when your business model becomes too reliant on paid acquisition, balancing between cash flow and paid ads will always put you in the red.

As a CEO, you should always be investing in long-term marketing tactics like blogging, social media, website optimization, and organic sources of traffic. This may mean hiring an in-house content team, SEO services, or co-marketing projects with other brands. Not only do these tactics drive engagement in the long run, but you’ll also create better value and lower the CAC.

At HubSpot, this has been a huge driver for our customer base, and we’ve been able to establish ourselves as a huge thought leader in the Saas space.

3. Pipedrive.com

Thought leader: Sean Evers

Position: Pipedrive’s VP of Sales

Think of CAC as a cross-functional metric. It is often associated with marketing or advertising costs spent on getting new customers. Although, measuring and improving sales efficiency along with adopting the right digital tools are equally important for optimizing CAC.

A disciplined go-to-market plan with clear CAC goals and objectives is key to success. Your monthly reporting should include CAC analysis by channels to clearly understand where to invest. It also shows which specific channels get saturated and needs to be removed from the next strategic sales plans.

Here are 3 tips on optimizing CAC:

- When times are tougher, think about your owned and earned channels. For example, past partnerships, old referrals, and prospects from previous campaigns or events. Anything where you have data in your systems that have already been paid.. This could serve as an alternative channel for getting new customers or rekindling old relationships.

- Use automation or digitization to optimize your customer journey. Deliver an automated self-service that customers will enjoy. It lets you build customer relationships with a minimal need for human contact. This frees up time to invest in other business-critical processes, reduces customer service costs and improves customer experience and satisfaction.

- To avoid customer saturation and the increase of your customer acquisition cost, think of rebalancing where your product or service is available – both geographically and by industry. A geographic or industry-based expansion helps you gain access to new customers or markets, reduce costs, expand the longevity of your current marketing or sales strategy, and increase the number of customer sources at tougher times.

4. Planable.io

Thought leader: Miruna Dragomir

Position: CMO at Planable

In my experience, CAC relies heavily on two factors: the relevance of the targeted audience and their level of intent. A higher degree of relevance and intent results in a higher conversion rate from user to customer.

For example, when using search ads with high-intent keywords the website conversion rate tends to be high, leading to a decrease in both CPL and CAC. At the same time, sponsoring a wide-ranging event typically involves a broad audience with little to no intent. It’s a TOFU tactic which has a low conversion rate, and consequently, a higher CAC (at least in the short term).

During periods of economic uncertainty, we typically reduce our emphasis on significant experiments and double down on BOFU channels and tactics. We’re scaling SEO, Search Ads, and limiting sponsorships to well-defined outlets such as micro-influencers and small, specific newsletters.

I believe that any business should regularly assess the CAC/LTV ratio. However, when cash flow and runway are secure, a company may intentionally compromise on this ratio. Making big marketing investments reduces CAC in the long run, but that ratio will definitely be affected for a while. Therefore, the company needs to be able to support that investment.

5. Scribehow.com

Thought leader: Nick Churcher

Position: Vp Growth at Scribe

- Clearly define what CAC means at your company, put robust tracking around it, and create reporting dashboards that are prominent and easily accessible to the key stakeholders. You can’t optimize a metric that is poorly defined or not frequently observed.

- Invest in attribution to understand your best-performing channels. Looking at CAC holistically doesn’t give you any granularity into them. There can be radical differences in performance between your ad channels. Over time, you should have an increasingly informed view of where to deploy ad budgets. A question I’m constantly asking is “for each incremental ad dollar we spend, where will we see the most productive return”?

- Utilize 3 main levers to improve CAC within channels: audience, creative and conversion rate optimization on the website/product experience. Continuous experimentation across these areas can yield big returns on reducing CAC while simultaneously increasing volume.

Don’t look at CAC solely. You should be monitoring other key metrics like payback period (how long does it take to recoup ad investment from the customer revenue it generates), CAC:LTV ratio and ROAS (return on ad spend). If you exclusively optimize for CAC, you can miss out on the big picture. You could succeed in lowering your CAC and increasing the volume of customers you acquire, but end up with less revenue. That is because the LTV of those customers is lower. It’s okay to increase your CAC if you see an equal or greater increase in generated value.

6. Veed.io

Thought leader: Rhea Cauilan

Position: PR specialist

- Focus on customer retention: It’s more cost-effective to retain existing customers than to acquire new ones. Offer personalized customer support, proactively ask customers to address their concerns, and provide incentives for loyal ones to stick around.

- Leverage organic channels: Organic channels such as SEO, content marketing, and social media can help drive traffic and leads to your website without incurring high costs. Focus on creating valuable content that resonates with your target audience and optimizing your website for search engines.

- Optimize your sales funnel: Analyze your sales funnel to identify areas where you can improve conversion rates and reduce churn. Use data for identifying bottlenecks and optimizing your messaging, as well as refining user experience to improve conversion rates.

7. Nicereply.com

Thought leader: Katarina Javorcikova

Position: Chief Customer Officer

- Sell to the right prospects: Selling to the right customers is a frontline of CAC optimization. It is generally costly and time-consuming to sell to the wrong prospects.Therefore, I recommend having a crystal clear ICP and adjusting your marketing and sales copies to your audiences and their issues.

- Identify acquisition sources of the higher-value customers: We are tracking acquisition sources that enlighten how companies learn about our solution. Then, we combine these sources with other figures such as company size, buyer persona, and use case. Utilizing the data, we identify where we should invest to acquire higher-value customers. Most clients convert when they are referred by our technology partners. As a result, we focus on nurturing our relationship with partners and preparing joint marketing activities (webinars, blogs, e-books). We are lucky our partners are willing to recommend our solution. In addition, our marketing team is running regular campaigns to gather product reviews and position our app among the top tools in the marketplace of our partners.

- Customer retention – motivate customers to switch to annual billing: We also conduct regular campaigns for encouraging clients to switch to annual billing plans. This way, you can effectively lower CAC. With monthly paying customers, you wait a while to see the return on your acquisition cost. Therefore, you should strive to convert loyal, satisfied monthly customers to annual billing. In order to be successful, this tactic requires an implemented strategy for customer retention.

8. Kickresume.com

Thought leader: Tomáš Ondrejka

Position: CMO at Kickresume

In today’s highly competitive SaaS landscape, optimizing customer acquisition costs while ensuring steady growth is a critical challenge businesses are facing. As a Co-Founder and CMO, I’ve had the opportunity to develop and implement strategies that effectively reduce CAC without hindering growth trajectory.

Here are my top tips for achieving this balance:

- Focus on customer retention: Did you know that acquiring a new customer costs five times more than retaining an existing one? So first, I’d advise you to focus on keeping your current customers happy with excellent support and regular feature updates. For example, we have an easily accessible online support and help center and continuously work on new features. Even right now!

- Invest in great content marketing: Creating high-quality content that addresses your target audience’s pain points not only positions you as an industry thought leader but also drives organic traffic and leads. You can do customer surveys, analyze competitors’ content, monitor online forums, or even collaborate with your customer support team. For example, if someone writes to our customer support asking what they should write in their CV for a Ph.D. position, we then create a guide about it.

- Leverage influencer partnerships: We were skeptical about influencer partnerships at first, but this approach has helped us reach a wider audience and reduce our CAC. We found that partnering with Twitter influencers in our niche was much more effective than traditional paid advertisements. Moreover, partnering with paid influencers often creates a ripple effect, where smaller influencers share similar content and mention your brand completely for free.

- Improve your website’s conversion rate: This one is a no-brainer. A well-optimized website is crucial for converting visitors into customers. Invest time in analyzing your website’s performance and identify areas for improvement. Perform an A/B test on different elements like copy, design, and CTAs. This way, we found that showing customer testimonials on our landing page really works well for us.

But remember, not all strategies work for every business. Continuously evaluate and iterate on your tactics to find what works best for you.

9. LOGO.com

Thought leader: Kari Amarnani

Position: Acquisition Marketing Manager

Cutting customer acquisition costs (CAC) is tricky when you’re dedicated to maintaining the same degree of value in your business. However, this is easily done with careful planning and execution.

People ultimately gravitate towards businesses that have their best interests at heart, not businesses that only care about scaling towards success. Though having both would be the ideal situation, if you find that optimizing your CAC would render your business less reliable, it’s time to reassess your current strategy.

Here are my 3 tips on how to optimize customer acquisition costs in the face of economic turbulence:

- Never compromise value for profit: Providing value must be at the forefront of everything you do. Customers resonate with brands that solve pain points, so your new strategy in optimizing your CAC must protect that facet of your business. At no point should you compromise your brand values to save a pretty penny.

- Prioritize content marketing: There’s no better feeling than getting results organically. Instead of relying on paid ads, build an arsenal of genuinely helpful content that allows readers to remember you the next time they need their questions answered. Promote your offerings, employ keyword research, and provide meaningful content. Rinse and repeat.

- Start building referral programs: Word-of-mouth is arguably the most powerful marketing strategy to acquire new customers organically. Offer incentives to existing customers for referring your services, as well as to new customers who you acquired through such referral. This has a cumulative effect on your strategy that can increase your customer base ten-fold if done right.

10. Close.com

Thought leader: Stefan Simonović

Position: Senior Outreach Marketing Manager

Reducing customer acquisition cost (CAC) is vital for building a profitable SaaS business. But, it can be challenging to figure out how to lower it. Luckily, there are plenty of ways to cut CAC and build a successful SaaS company! Here are some tips that can help you reduce your CAC and increase your profits:

- Focus on customer segmentation: By segmenting your customers, you can identify those with the highest lifetime value and invest in resources to retain them. Prioritize retaining high LTV customers, through customer support teams and account managers.

- Make customer satisfaction a top priority: Improving customer satisfaction can reduce churn rates and increase customer lifetime value. Provide excellent customer service and address any issues promptly to keep customers happy.

- Get your customers to spread the word: Encourage happy customers to refer their friends and colleagues to your product. Word-of-mouth marketing can be a powerful tool that doesn’t require spending significant marketing resources.

- Optimize your pricing strategy: Pricing can significantly impact your customer acquisition costs. Conduct pricing experiments to find the most effective strategy for your target customers.

11. SocialBee.com

Thought leader: Roxana Motoc

Position: Head of Marketing, SocialBee

At SocialBee, we use a combination of the three strategies listed below. We have found that focusing on targeted audiences and providing excellent customer service has helped us reduce CAC while still acquiring valuable customers.

- Target your marketing: Rather than casting a wide net, focus your marketing efforts on targeted audiences that are most likely to convert into paying customers. By leveraging customer data and using targeted ads, you can reduce CAC and increase conversion rates.

- Improve customer retention: Acquiring new customers is expensive, so it’s essential to retain existing ones. By providing excellent customer service, improving product quality, and offering loyalty programs, you can increase customer retention rates and reduce CAC.

- Use affiliate marketing: Affiliate marketing is an effective way to reduce CAC by leveraging your existing customer base. When you offer incentives to current customers who refer new leads, you increase their loyalty and reduce your acquisition costs quite a lot.

12. CrankWheel.com

Thought leader: Jói Sigurdsson

Position: Founder & CEO at CrankWheel

Do the unscalable, invest your time in your customers. You might have been forced to cut down on events and ads but you can still grow by Word of Mouth.

Every customer is now your new best friend. Engage with them and personally reach out. You will soon find out what they like about your product, what can be improved and where you can cut. You might even discover new sources of growth.

Finish conversations with happy customers by asking them to post about their experience with your product, write reviews or refer others. Don’t be afraid to experiment and find out what works best. Once your customers start to refer new customers who in return refer new customers, you can streamline the outreach process. New customers will also help you find friction points that can be eliminated.

To summarize, you can:

- Invest time in engaging with and understanding your customers.

- See if there are groups of customers that are more likely to grow during economic downturns.

- Enable and encourage customers to refer their friends and colleagues.

- Experiment and find ways to streamline what works best.

13. Gepard.io

Thought leader: Maryna Tarasenko

Position: Head of Marketing at Gepard

- Focus on Conversion Rate optimization. CAC directly depends on the CR, so my first and foremost advice here is to dive deeply into the market benchmarks for your industry and compare them with your numbers. This will give you a general understanding of whether your website converts great or whether you need to make immediate improvements. Be particularly attentive to the “Trial to paying customer” funnel stages since your primary goal is to decrease CAC. Do not forget to allocate around 5%-10% of your budget to CR optimization and continuously test hypotheses as the most successful companies do.

- Conduct an in-depth ICP analysis regularly. The market changes so fast that it is worth reviewing your ICP at least once per year, and it should also be based on the incoming leads. It may turn out that your website generates people that do not match your current ICPs. If that is the case, I recommend checking the following: does the competition create a new reality, thus should your solution be adapted to the leads’ expectations? Or is there an issue with your marketing messaging? Investing money and attracting an audience inconsistent with your ICP definitely won’t lower the CAC.

- Segment your leads and tailor marketing messaging. This connects to the previous point. You should be aware of ICPs issues and background, and speak with them in their language. I suggest dividing leads within your nurturing campaigns based on what is their goal with your service and on their topical awareness level. Define whether they need to be educated on how your solution can serve their needs or if they already know fundamentals and expect more PRO tips/insights. The personalized marketing approach may sound like a buzzword today, but when implemented diligently – it might be a secret ingredient in your CAC optimization strategy.

14. Groupboss.io

Thought leader: Omar Nasif

Position: Chief Marketing Officer at Groupboss

Focus on Content Marketing

Content marketing plays a significant role in reducing customer acquisition cost. First of all, it must have business value. Content for SaaS should not be like a general essay. Write high-quality content. Make sure that you are getting long-term benefits which will eventually reduce your CAC.

For mastering SaaS content marketing, remember the following:

- Do enough research while writing the content.

- Content should be in simple language so that all users can read it. Remember, adding difficult and unknown words doesn’t add quality.

- Provide business value.

- Try to identify the pain points of the potential customers and provide them with solutions.

- Don’t be too salesy – go easy on CTAs, pop-ups, etc.

- Make sure the content is fully SEO optimized.

- Focus on Off-page SEO to increase the organic traffic of your content.

- From time to time, you can repurpose your already created content.

15. Brafton.com

Thought leader: Estrella Alvarado

Position: SEO Specialist

Unlike paid channels that stop showing results once you stop buying ads, organic marketing strategies can continue to generate results even after you put the initial effort into it. In the long run, this means that organic marketing leads to better ROI and lower CAC.

If you want to improve your SaaS product’s visibility and drive traffic cost-effectively, implementing SEO is a good idea. By improving your website’s ranking on the SERPs, you can attract people who are actually interested in what you offer and reduce your customer acquisition costs. Creating listicles that compare the top SaaS products in your niche is a great way to put your brand on the radar and showcase your unique solution.

In addition to SEO, email marketing is also an effective way to nurture leads and move them through your sales funnel. By automating your email campaigns, you can save time and resources while still delivering personalized and timely messages. Classifying your contacts by industry, company size, region, etc. can help you create more personalized emails that are more effective in generating leads.

Lastly, customer retention is essential to reducing customer acquisition costs. So, instead of just focusing on acquiring new customers, it’s crucial to look after those who are already on your customer base. Provide efficient customer service, address their pain points, ask for feedback, and regularly engage with them through personalized email campaigns. This approach will help you build strong relationships, which is more beneficial in the long run.

While these activities might take a little longer to start showing results than paid campaigns, they will not only help you reduce CAC but also improve your brand awareness.

16. ProfileTree.com

Thought leader: Ciaran Connolly

Position: Founder, ProfileTree

Ciaran Connolly, founder of ProfileTree, has consistently emphasized the long-term value of SEO. His perspective, shaped by over a decade of helping UK-based businesses grow online, is clear: SEO should be treated as a business asset, not a one-off marketing campaign.

In blog posts and interviews, Connolly highlights how sustainable, organic strategies—like evergreen content, technical optimization, and consistent blogging—can reduce CAC over time. Under his leadership, ProfileTree has helped companies turn their websites into high-performing lead generators by focusing on what compounds: value-driven content and strong search visibility.

Conclusion

In conclusion, optimizing customer acquisition costs is essential for SaaS businesses, especially during times of economic turbulence. CAC is calculated by dividing sales and marketing costs by the number of new customers acquired, and it plays a crucial role in identifying effective customer acquisition channels and tactics.

By following our CAC optimization playbook from experts in the industry, your business can develop a sustainable and profitable customer acquisition strategy.

To further optimize your CAC and take your customer acquisition strategy to the next level, consider trying out CloudTalk’s next-gen business calling software. With features like call routing, IVR, and real-time analytics, CloudTalk can help your business streamline its sales and marketing efforts, reduce costs, and boost customer satisfaction.

Try CloudTalk today and see the difference it can make for your business!

Retain Customers and Win Their Loyalty

What did you find in this article?

What are some examples of customer acquisition costs?

Customer acquisition cost (CAC) is the overall expense of sales and marketing to acquire a new customer within a specific timeframe. This includes costs related to various programs and marketing campaigns, salaries, commissions, marketing and sales software, bonuses, and overheads involved in attracting leads, converting them into paying customers and overall increasing sales.

What distinguishes Cost Per Acquisition from Customer Acquisition Cost?

While CAC measures the cost of acquiring a paying customer, Cost Per Acquisition (CPA) measures the cost of acquiring a lead who has taken a desired action, such as signing up for a free trial. CAC gives a holistic view of a business’s relationship with the average paying customer, while CPA is more of a campaign-level metric that examines the cost/profit ratio of particular marketing channels like SEO, PPC, SMS, cold calls, etc. Because of varying factors and costs, each CPA calculation for a marketing channel is its own unique equation.

What is meant by CAC?

Customer acquisition cost (CAC) refers to the cost associated with gaining a new customer. Simply put, CAC refers to the expenses and resources involved in obtaining and approaching new customers. It is a vital metric for businesses and is often used in conjunction with the customer lifetime value (LTV) metric to evaluate the value produced by a new customer. This is why it’s crucial to focus on your marketing and sales alignment.

How do you calculate CAC payback?

To determine the CAC payback period, a business must first calculate its customer acquisition cost (CAC) by collecting information from marketing and sales teams on ad spend, content creation, publishing costs, and department overheads. Once this information has been gathered, divide the total costs by the number of customers gained. This is the average acquisition cost for the business, and now you’ll be able to calculate the CAC payback period.

Therefore, it is important for businesses to ensure their customer approach process is as efficient as possible to operate effectively without exceeding their budget. By doing so, companies can reduce their customer acquisition costs and improve their CAC payback period.

What is the formula for CAC payback?

Calculating the CAC payback period is as simple as taking the customer acquisition cost (CAC) and dividing it by the monthly recurring revenue (MRR). To be profitable and prevent customer churn, you should always treat your customers well and measure overall customer satisfaction to build their loyalty and trust.

What is the difference between customer acquisition and retention costs?

Customer acquisition cost (CAC) is the expense of acquiring a new customer, which includes all expenses involved in attracting and converting a prospect into a paying customer, such as marketing, advertising, sales, and onboarding costs. CAC is a crucial metric for businesses to assess the effectiveness and efficiency of their customer acquisition strategies.

On the other hand, customer retention cost (CRC) is the cost incurred by a company to retain an existing customer. This includes all expenses related to treating customers well and keeping them happy and engaged, such as providing customer support, loyalty programs, and ongoing services. CRC is a significant metric because retaining customers is typically less expensive than acquiring new ones.

In summary, CAC focuses on the costs associated with attracting new customers, while CRC focuses on the costs associated with retaining existing customers.