AI for Insurance Agents: 15 Best Tools for 2025

As an industry inundated with paperwork and lengthy, repetitive processes, insurance was quick to adopt AI. And now, AI for insurance companies is expected to increase productivity and lower operating costs by 40%*.

From claims processing to fraud detection and underwriting, it’s fair to say that the AI use cases in health insurance are many and varied. In this article, we’ll introduce you to the 15 best AI tools for each of those to power up your operations in 2025.

Get ready to discover the best AI for insurance agents, along with their key features, benefits, and downsides, as well as prices, and target customers. Keep reading!

Key Takeaways:

- AI automates claims, fraud detection, and customer service, helping agents work smarter, reduce errors, and improve efficiency.

- From CloudTalk for outreach to Shift Technology for fraud detection, the right tools can streamline operations and cut costs.

- Focus on compliance, integration, automation, scalability, and ROI to ensure the best fit for your agency’s needs.

What Is AI in Insurance & Why Does It Matter?

Target Area

What It Is

AI Description

AI Examples

Underwriting

The evaluation of an applicant’s information to determine coverage, pricing, etc.

AI analyzes vast amounts of data quickly, improving assessment accuracy and speed.

Predictive analytics, Risk modeling, Automated scoring.

Fraud Detection

Investigation of suspicious claims and policy applications to prevent losses.

Machine learning algorithms identify unusual patterns, flagging potential fraudulent activities.

Anomaly detection,

Pattern recognition,

Real-time alerts.

The review, validation, and subsequent approval or refusal of claims.

AI automates the claims process, reducing the time and effort needed to handle claims.

Chatbots,

AI documentation, Instant approvals.

Customer Service

The support of policy-holders for inquiries, claim assistance, policy updates, and issue resolution.

AI enhances personalized customer interactions, providing fast responses.

Virtual assistants, Chatbots, Personalized recommendations.

Alone, these tools can offer significant benefits in their target areas in terms of productivity and time-saving. But their true value comes to light when you leverage multiple in order to build a comprehensive, insurance tech tool stack. For example, pairing fraud detection systems with tools like an AI image detector can help insurers verify visual claims more accurately and quickly flag any potential image manipulation or inconsistencies.

In combination, these AI solutions for insurance help you create a faster, more accurate insurance process that both saves you money and helps you generate additional revenue via higher outreach and more satisfied customers.

15 Best AI Tools for Insurance Agents in 2025

We’ve teased the value of the best AI tools for insurance agents long enough. Below, you’ll find a succinct, but comprehensive overview of the top 15 providers available on the market today, in 2025.

#1: CloudTalk

CloudTalk is an AI-powered business communication software, designed to help you have better, crystal-clear customer conversations, while improving your outbound and inbound efforts across 1 + countries via calls, SMS, and WhatsApp.

Key Features:

- Conversation Intelligence AI

- Intelligent Call Routing & IVR

- Power & Smart Dialer Software

- Real-Time Analytics & Call Monitoring

- 3rd Party Integrations for CRMs, Helpdesks, etc

Pros & cons

Pros:

- Crystal-clear call quality across 1+ countries.

- Powerful AI and automated tools for better productivity

Cons:

- Requires a stable internet connection

- Better-suited for SMBs and MMBs over Enterprises

Pricing:

Best for:

Insurance agents focused on sales and client outreach

#2: Kenyt.AI

Kenyt.AI provides intelligent chatbots and AI-powered automation to streamline customer interactions and claims processing. It is best used for automating policy inquiries, lead qualification, and claims handling for faster responses and higher CSAT.

Key Features:

- AI chatbot with Natural Language Processing (NLP)

- Automated claims submission and tracking

- Lead generation and policy recommendations

- 24/7 virtual assistant support

- Integration with CRM tools

Pros & cons

Pros:

- Reduces manual workload for agents

- Enhances customer service with instant responses

Cons:

- Requires training for optimal performance

- Some advanced features require premium plans

Pricing:

Starts at $75 per 250 chats, paid monthly

Best for:

Agencies looking to automate customer support

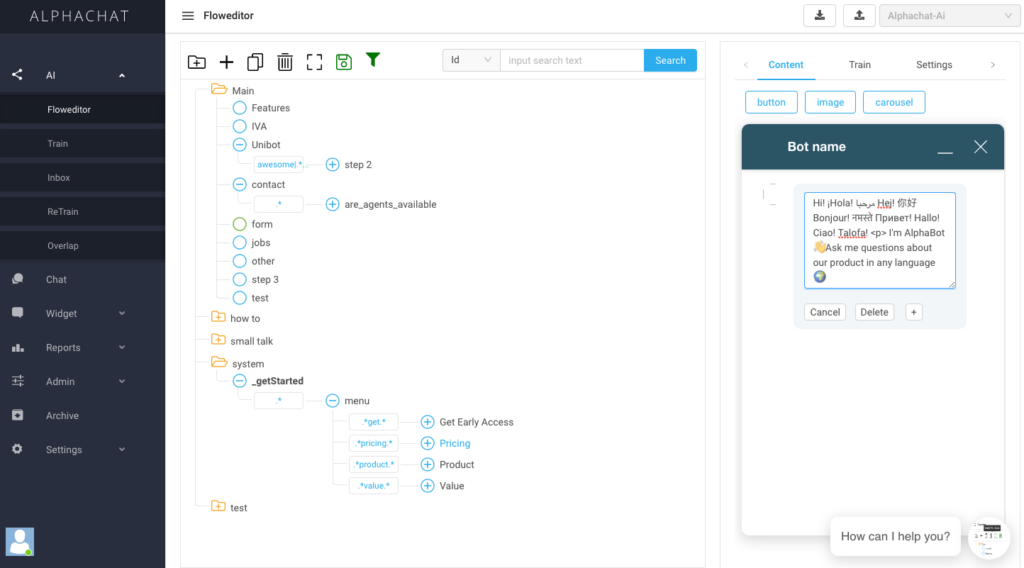

#3: AlphaChat

AlphaChat is a no-code AI chatbot platform designed to improve customer support and claims management for insurers. It enables insurers to automate client interactions while ensuring a personalized experience through its Natural Language Understanding (NLU).

Key Features:

- AI chatbot with self-learning capabilities

- Secure authentication for policyholder interactions

- Automated claims filing and tracking

- Multilingual support for global insurance firms

- Customizable conversation flows

Pros & cons

Pros:

- No coding required for setup

- Improves operational efficiency

Cons:

- May need fine-tuning for industry-specific queries

- Can require third-party integrations for full functionality

Pricing:

Available per request.

Best for:

Mid-to-large insurance companies

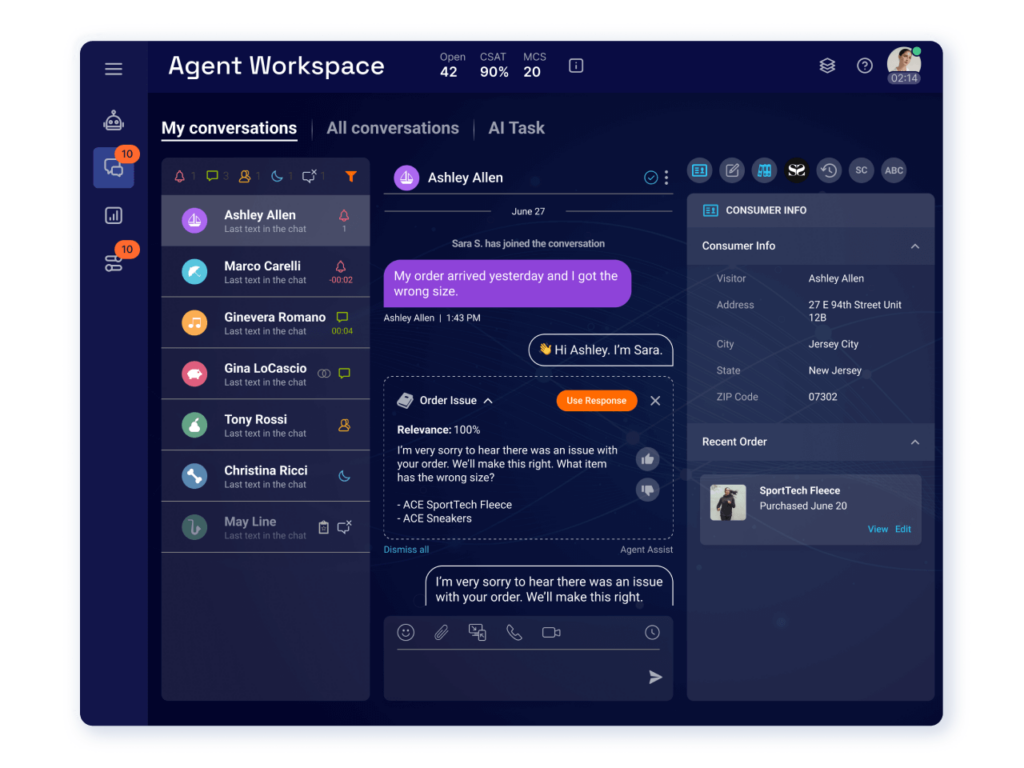

#4: LivePerson

LivePerson uses AI-driven conversational bots to improve engagement and reduce response times for policyholders. Its AI-powered messaging platform allows agents to handle multiple inquiries simultaneously, improving efficiency and customer experience.

AlphaChat is a no-code AI chatbot platform designed to improve customer support and claims management for insurers. It enables insurers to automate client interactions while ensuring a personalized experience through its Natural Language Understanding (NLU).

Key Features:

- AI-powered messaging and voice bots

- Sentiment analysis for real-time insights

- Seamless integration with insurance platforms

- Omnichannel support (SMS, WhatsApp, Web, etc.)

- Automated appointment scheduling

Pros & cons

Pros:

- Enhances customer satisfaction with instant responses

- Reduces agent workload through automation

Cons:

- Can be complex to configure for smaller teams

- Some features locked in higher-tier plans

Pricing:

Available per request.

Best for:

Large insurance agencies with high customer interaction

#5: Zendesk Answer Bot

Zendesk Answer Bot automates responses to common queries, helping insurance agents resolve customer issues faster. Its AI-powered Flow Builder allows for smooth automation of customer interactions, reducing support costs and improving CSAT.

Key Features:

- AI-powered chatbot with Flow Builder

- Knowledge base integration for quick answers

- Smart ticket routing and automation

- Omnichannel customer support

- Real-time analytics dashboard

Pros & cons

Pros:

- Reduces response time for policy inquiries

- Integrates with existing support systems

Cons:

- Limited customization in basic plans

- May require API integrations for advanced workflows

Pricing:

Starts at $49 per agent/month

Best for:

Agencies focused on customer service automation

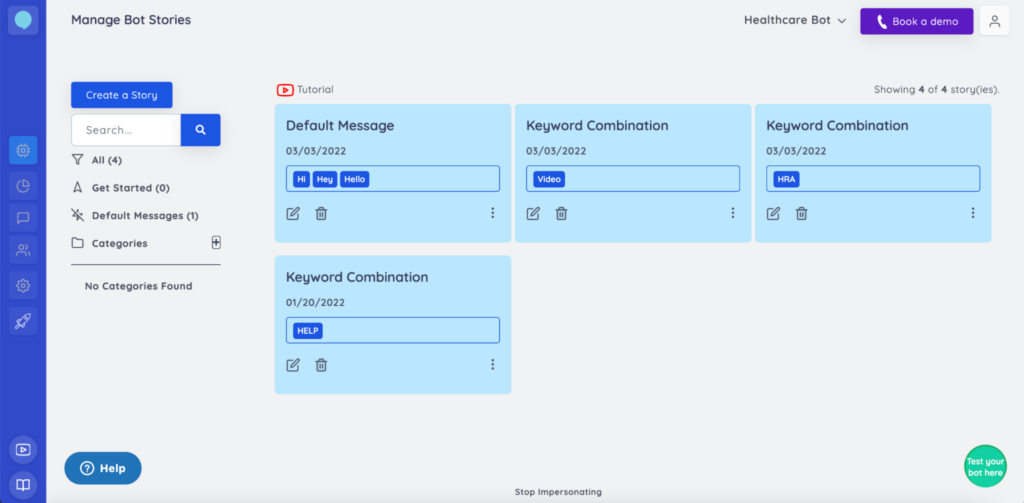

#6: Botsify

Botsify offers AI-driven chatbot solutions to automate lead generation, policy sales, and claims processing. It helps insurance agencies handle a high volume of inquiries, ensuring faster and more accurate responses to client questions.

Key Features:

- AI chatbot with pre-built insurance templates

- Automated lead qualification and customer support

- Human handover for complex queries

- Multichannel support (Web, WhatsApp, SMS)

- Integration with policy management software

Pros & cons

Pros:

- Helps agents handle high-volume inquiries efficiently

- Reduces operational costs

Cons:

- Requires regular updates to maintain chatbot accuracy

- Free plan has limited features

Pricing:

Starts at $50 per month

Best for:

Small to mid-sized insurance agencies

#7: Arteria AI

Arteria AI specializes in AI-powered contract management for insurers, helping streamline policy generation and compliance. Its ML capabilities enable insurance companies to quickly analyze, compare, and generate contracts with accuracy.

Key Features:

- AI-assisted contract creation and analysis

- Automated policy comparisons and risk assessments

- Machine learning for regulatory compliance

- Integration with document management systems

- Real-time policy updates and tracking

Pros & cons

Pros:

- Speeds up policy generation and risk assessment

- Enhances compliance tracking

Cons:

- Higher learning curve for smaller teams

- Requires integration with existing software

Pricing:

Available per request.

Best for:

Large insurance firms and brokerss

#8: Rewind AI

Rewind AI provides a searchable recording of everything that happens on a user’s computer, helping insurance agents track conversations, retrieve past policy discussions, and ensure regulatory compliance with accurate documentation.

Key Features:

- AI-powered search for past interactions

- Automated recording and indexing

- Voice-to-text transcription for documentation

- Secure storage with encryption

- Integration with CRM and email systems

Pros & cons

Pros:

- Helps agents easily recall customer interactions

- Reduces errors in policy discussions

Cons:

- Requires ample storage space

- Limited mobile compatibility

Pricing:

Insurance agents needing detailed conversation history

Best for:

Large insurance firms and brokerss

#9: Gradient AI

Gradient AI is a powerful AI-driven platform that helps insurers optimize underwriting and claims management. By leveraging advanced ML models, Gradient AI enhances risk assessment, automates claims processing, and improves fraud detection.

Key Features:

- AI-powered risk assessment for underwriting

- Automated claims processing with predictive analytics

- Fraud detection through machine learning models

- Seamless integration with existing insurance systems

- Customizable AI models based on industry data

Pros & cons

Pros:

- Improves accuracy in underwriting decisions

- Enhances fraud detection capabilities

Cons:

- Requires substantial data for optimal performance

- Implementation may be complex for smaller agencies

Pricing:

Available per request.

Best for:

Insurance firms needing compliance and workflow automation

#10: Limit AI

Limit AI is designed for insurance brokers, offering AI-powered automation for quoting, underwriting, and risk assessment. It reduces manual processes and increases accuracy in policy evaluations.

Key Features:

- AI-based quote generation

- Risk assessment automation

- Surplus lines tax and fee calculations

- AI-driven policy recommendations

- Integration with brokerage systems

Pros & cons

Pros:

- Speeds up quoting and underwriting

- Reduces manual errors in policy processing

Cons:

- Requires customization for specific agencies

- Some features limited to enterprise plans

Pricing:

Available per request.

Best for:

Insurance brokers optimizing underwriting processes

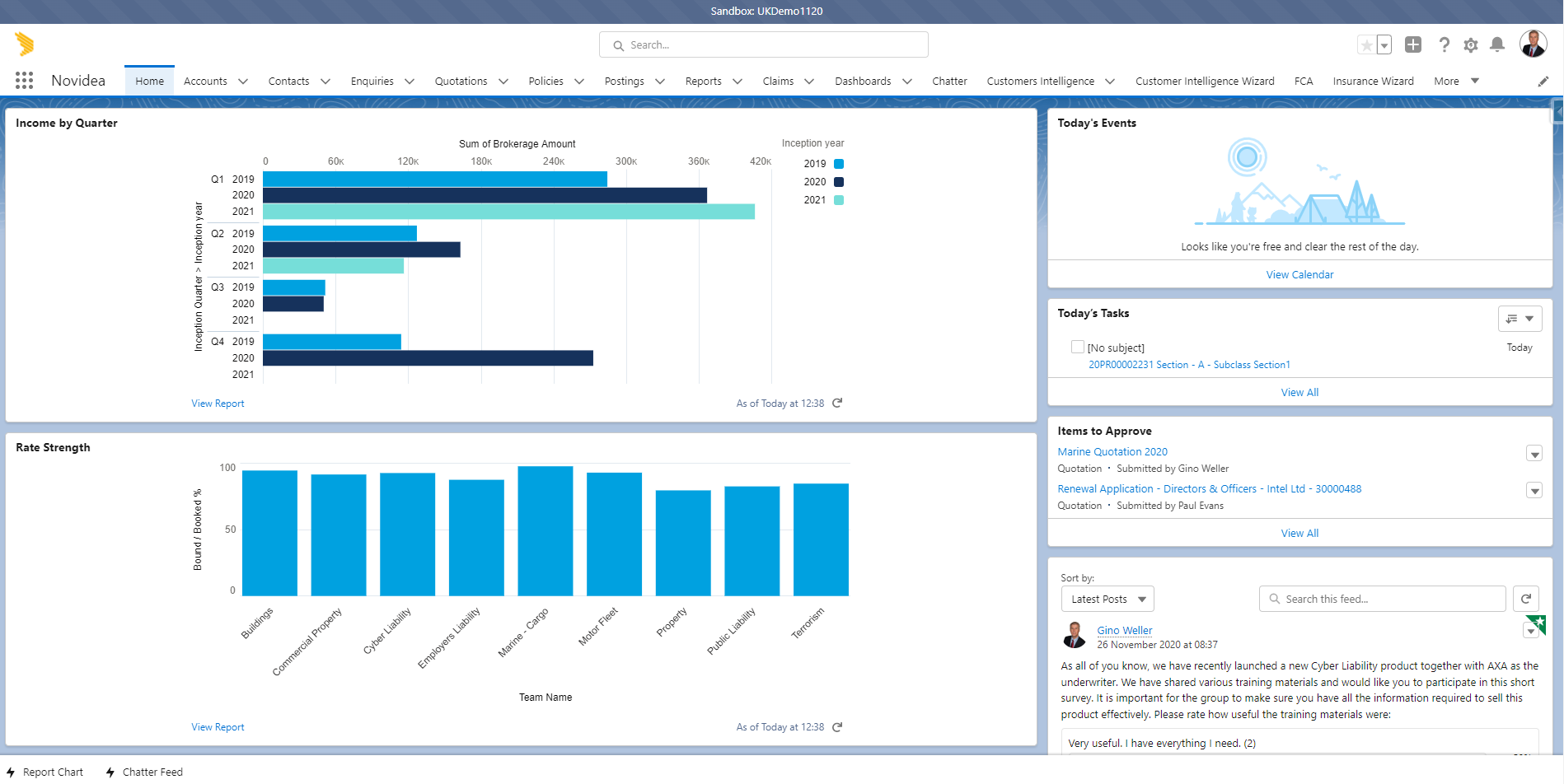

#11: Novidea

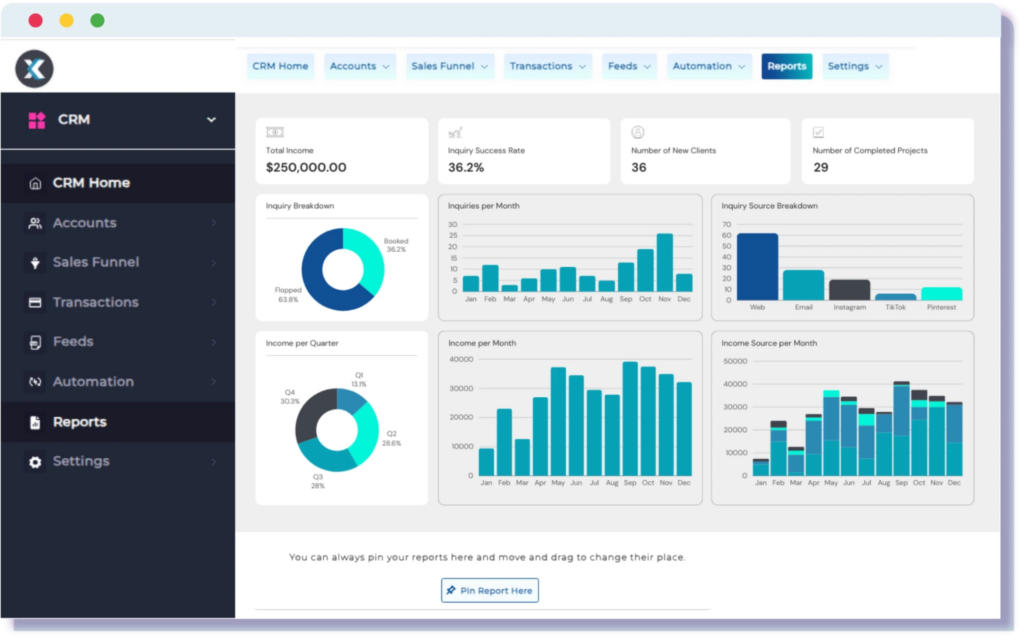

Novidea offers an AI-powered insurance brokerage management platform that helps streamline customer relations, policy administration, and sales automation, improving operational efficiency.

Key Features:

- AI-powered brokerage CRM

- Automated sales and customer engagement

- Policy lifecycle tracking and reporting

- Workflow automation for agencies

- Data analytics for client insights

Pros & cons

Pros:

- Improves efficiency in policy administration

- Enhances customer relationships with AI-driven insights

Cons:

- Requires system integration for full functionality

- Advanced features may require training

Pricing:

Available per request.

Best for:

Large insurance agencies and brokerage firms

#12: Jasper AI

Jasper AI is an AI-powered content generation tool helping insurance agents create marketing materials, client emails, and blog posts to improve outreach and brand authority.

Key Features:

- AI-generated marketing copy

- Automated blog and email writing

- Content optimization for SEO

- Customizable tone and style

- Multi-language support

Pros & cons

Pros:

- Saves time on content creation

- Helps maintain consistent brand messaging

Cons:

- Requires manual review for accuracy

- Subscription cost may be high for smaller agencies

Pricing:

Available per request.

Best for:

Insurance agents needing automated marketing content

#13: Chisel AI

Chisel AI specializes in automating document processing for insurers, enabling rapid analysis of policy documents, contracts, and regulatory paperwork to enhance insurance efficiency.

Key Features:

- AI-powered document parsing and classification

- Automated contract analysis

- Policy compliance checking

- Machine learning for text extraction

- Integration with insurance software

Pros & cons

Pros:

- Speeds up document review and compliance checks

- Reduces manual paperwork

Cons:

- Requires training for optimal accuracy

- High initial implementation cost

Pricing:

Starts at $79 per user/month. Free version available.

Best for:

Insurance firms handling large volumes of paperwork

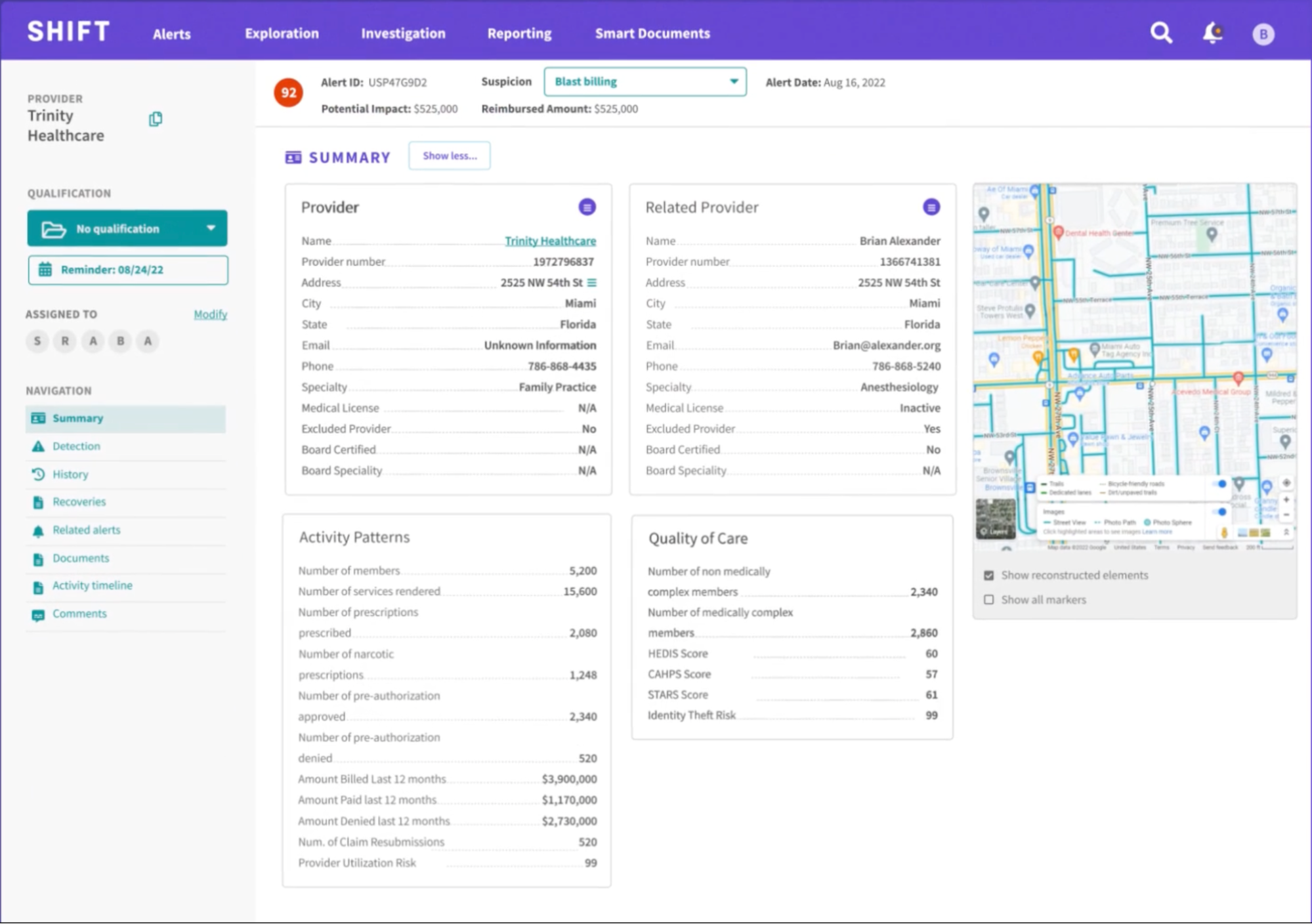

#14: Shift Technology

Shift Technology is a leading AI-powered platform specializing in claims automation and fraud detection for insurance companies. It helps insurers streamline claims processing, detect fraudulent activities, and improve decision-making using advanced data analytics.

Key Features:

- AI-powered claims automation to speed up processing

- Advanced fraud detection using machine learning algorithms

- Real-time risk assessment and decision support

- Seamless integration with existing insurance platforms

- Predictive analytics for better fraud prevention

Pros & cons

Pros:

- Improves accuracy in claims and fraud detection

- Reduces operational costs and manual workload

Cons:

- Requires customization for optimal results

- Implementation may be complex for smaller insurance firms

Pricing:

Available per request.

Best for:

Insurance companies aiming to optimize claims processing and strengthen fraud detection mechanisms

#15: Aveni

Aveni provides AI-powered compliance and risk management solutions for insurance firms, using AI-driven speech analytics to enhance compliance monitoring and quality assurance.

Key Features:

- AI-powered speech analytics

- Compliance risk monitoring

- Automated quality assurance checks

- Voice data analysis for policy adherence

- Integration with customer call systems

Pros & cons

Pros:

- Helps meet regulatory compliance standards

- Enhances call quality monitoring

Cons:

- Requires training for optimal accuracy

- Integration needed for seamless workflow

Pricing:

Available per request.

Best for:

Insurance firms needing AI-driven compliance monitoring

The Benefits of Using AI for Insurance

We’ve touched on several of the benefits that AI for life insurance agents can provide, but if it were not clear, here are the top 5 things you can expect to enjoy after onboarding:

- Faster Claims Processing: AI automates claims evaluation, reducing the time needed to assess, approve, or reject claims, leading to quicker payouts.

- Enhanced Fraud Detection: Machine learning models analyze claims data to detect suspicious activity, reducing fraudulent payouts and financial losses.

- Improved Customer Service: AI chatbots and virtual assistants handle policy inquiries, claims tracking, and support requests 24/7, enhancing customer satisfaction.

- Better Risk Assessment: AI-driven analytics evaluate applicant data, helping insurers price policies more accurately and reduce underwriting risks.

- Operational Efficiency & Cost Savings: Automating repetitive tasks, like document processing and customer verification, frees up time and reduces administrative costs.

Key Factors to Consider When Choosing an AI Tool for

Insurance

Selecting the right AI solution is crucial for maximizing efficiency and ensuring compliance. Below are the key factors insurance agents should evaluate before investing in AI tools:

- Compliance & Security: Ensure the tool meets HIPAA, GDPR, and industry regulations, with encryption and access controls for data protection.

- Integration with Existing Systems: Look for CRM and policy management software compatibility to streamline workflows.

- Automation Capabilities: Identify tools that automate claims processing, fraud detection, underwriting, and customer service effectively.

- Scalability: Choose a solution that adapts to growing policy volumes and supports agencies of different sizes.

- Pricing & ROI: Evaluate the total cost vs. expected benefits, ensuring the tool improves efficiency and reduces costs.

Ensure Your Business’ Future with CloudTalk

Although many customers and agents fear that AI will replace all human interactions, we’re still very far from that happening. And until then, insurance agents need all the help they can get reaching new applicants and answering customer questions.

Luckily, CloudTalk’s Conversational Intelligence AI can do just that. Remove time-consuming contact management from your daily workflows and efficiently personalize your conversations to deliver a better experience at every turn.

See What CloudTalk Can Do For You

Source:

FAQs

Are AI tools secure for handling sensitive client data?

Yes, most AI tools follow HIPAA, GDPR, and encryption standards to protect client data. Always verify compliance before use.

Can AI replace insurance agents?

No, AI assists agents by automating tasks like claims and fraud detection, but human expertise is still essential for decision-making.

How can AI help insurance agents?

AI automates claims, fraud detection, and customer support, improving efficiency, reducing errors, and enhancing client service.

Is AI in insurance secure and compliant?

Most AI tools follow strict security and compliance standards like HIPAA and GDPR, but insurers must ensure proper implementation.

How much does AI for insurance agents cost?

Pricing varies from $50/month for basic AI chatbots to enterprise-level solutions costing thousands per month, depending on features.