10 Cold Calling Scripts For Loan Officers: Convert Leads Into Clients

In 2023, loan officers facilitated over $2.7 trillion in mortgage originations. That’s millions of families moving into new homes, thousands of businesses getting off the ground, and countless dreams turning into reality.

But here’s the kicker: The modern loan officer isn’t just competing against other banks –they’re up against algorithms, apps, and a generation of borrowers who expect instant gratification.

So, how do you stand out in a sea of options? How do you turn cold leads into warm relationships, and skeptical prospects into satisfied clients? It all starts with mastering the art of the cold call.

Buckle up, loan officers. We’ll show you the strategies, scripts, and secrets that separate the top performers from the also-rans.

Key takeaways:

- Build rapport with the borrower, avoiding a pushy sales approach. Instead, focus on understanding their needs and becoming a valuable member of their financial team.

- Offer a consultative approach where you position yourself as a problem solver rather than just a seller of financial products.

- Your ability to clearly explain loan packages, interest rates, and payment terms can make or break a deal. The focus should be on how your knowledge directly benefits the borrower’s specific situation.

Start calling with a complimentary virtual phone number for 14 days free!

Why Is a Loan Officer Script Important?

A solid script isn’t a crutch; it’s a springboard. It provides structure, ensuring key points are covered. But more than that, it allows loan officers to focus on listening and building rapport.

Think of it as a roadmap. You know where you’re going, but you can still adapt to the terrain. This flexibility is crucial in financial services, where each client’s needs are unique.

All in all, a sales script helps you:

- Deliver Consistent Messaging

- Streamline Conversations

- Enhances Efficiency

- Boosts Confidence

- Remain Compliant

- Handle Objections

10 Effective Cold Calling Scripts for Loan Officers

Sean, a battle-hardened loan officer with SilverStar Mortgage, is staring at his phone. He’s been in the trenches for over a decade, transforming cold leads into happy homeowners. But today, he’s facing his toughest challenge yet.

SilverStar’s CEO just dropped a bombshell: They’re aiming to grow their market share 50% in 12 months. Sean has been tapped to lead a squad of hungry young loan officers to make it happen using cold calls.

The catch? They need to do it in a market that’s more crowded than a rush-hour subway.

1. Initial Contact with Decision Makers

2. Reaching Out to Realtors

3. Following Up on Leads

4. Addressing Rate Concerns

5. Reconnecting with Past Clients

6. Pitching to Small Business Owners

7. Handling the “Send Me Some Information” Brush-Off

8. Approaching Refinancing Opportunities

9. Reaching Out to First-Time Homebuyers

10. Addressing Credit Score Concerns

Try CloudTalk and supercharge your cold calls!

Benefits of Loan Officer Scripts

We already discussed briefly how a sales script can help loan officers, but let’s clarify the subject to better understand the benefits of a script.

- Deliver Consistent Messaging: Scripts ensure every prospect hears your key value propositions about bridging loans and other products, maintaining brand integrity and a unified approach across your team.

- Improve Sales Reps’ Confidence: A well-practiced script reduces anxiety, improves delivery, and allows loan officers to focus on building rapport rather than worrying about what to say next.

- Handle Objections Better: Scripts prepare you for common push-backs with tested responses, allowing for smoother conversations and increased conversion rates.

- Manage Time Effectively: Sales scripts keep calls focused and productive, respecting both your time and the prospect’s, leading to more efficient use of work hours.

- Stay Compliant: Cold calling scripts make sure that all communication adheres to industry regulations and company policies, reducing the risk of legal issues.

- Increase Adaptability: Scripts serve as a flexible framework that can be customized on-the-fly, allowing loan officers to tailor their approach based on the prospect’s unique situation and responses.

Best Cold Calling Practices for Loan Officers

So, how do the top loan officers turn cold calls into hot leads? It’s not magic, and it’s certainly not luck. It’s about following a set of tried-and-true practices that separate the pros from the amateurs. Let’s hear them out.

Do Your Homework

We’re flooded with data. With so much data about your prospects, not knowing their name or not having the right product for them is just inexcusable. Luckily, with a phone system CRM that enables personalization, this is a thing of the past. So, before you dial, dive deep.

- Check local news for community developments that might impact housing needs

- Scan social media profiles for personal interests or recent life events

- Review property records to understand their current situation

Remember, knowledge isn’t just power –it’s the key to personalization. When you show you’ve done your research, you’re not just another voice on the phone. You’re a professional who cares.

Master the Art of Listening

Your script isn’t a straitjacket. You can always deviate from it, but only if you’ve been listening. Use it to launch meaningful conversations, not monologues.

- Practice active listening techniques

- Use verbal nods to show engagement

- Ask follow-up questions based on their responses

The goal? Turn your call into a dialogue, not a speech. After all, you have two ears and one mouth for a reason.

Practice Makes Perfect (or at least Pretty Good)

Confidence is key, and nothing breeds confidence like preparation.

- Record your calls (with permission) and analyze them

- Set up regular role-playing sessions with your team

- Seek feedback from seasoned colleagues

Think of it like a professional athlete preparing for the big game. The more you practice, the more natural you’ll sound when it really counts.

Keep It Real

Nobody likes talking to a robot. Unless you’re selling actuarial tables, ditch the corporate speak.

- Use conversational language

- Share relevant anecdotes or experiences

- Be ready to go off-script when the moment calls for it

Remember, you’re not just selling loans. You’re building lasting relationships that will last for years until someone pays the loan fully. And relationships thrive on authenticity, especially when it’s about money.

Follow-up Elegantly

The fortune is in the follow-up. One call rarely seals the deal, so plan your pursuit strategy.

- Create a systematic follow-up schedule

- Vary your communication methods (email, text, social media)

- Provide value with each touch (market updates, helpful tips, etc.)

Think of each prospect as a garden. One watering isn’t enough –it takes consistent nurturing to see growth. But just like plants, overwatering can kill. Give prospects their space too.

Embrace the Power of Timing

Timing is everything. Know when to call, and more importantly, when not to.

- Research industry trends for optimal calling times

- Be mindful of time zones and local events

- Respect do-not-call lists and regulations

Keep in mind that the best cold call is one that doesn’t feel cold at all. It feels timely, relevant, and welcome.

Harness Technology

Your phone isn’t your only tool. Go omnichannel and leverage cold calling software to connect with your prospects across different touchpoints. A cloud-based phone system can supercharge your cold calling efforts.

- Use CRM systems to track interactions and set reminders

- Employ auto-dialers for efficiency (but use them wisely)

- Integrate email follow-ups with your calling strategy

Think of technology as your personal assistant, helping you stay organized and efficient. But it’s not just about connecting with prospects; once loans are set up, you need a robust infrastructure to manage them effectively. This is where loan tracking software becomes invaluable, as it helps lenders monitor repayments, manage accounts, and streamline servicing.

Ditch Guesswork and Leverage AI to Enhance Calls

As a loan officer, your role extends far beyond making calls. You’re an educator, a risk manager, and a link between borrowers and financial opportunities.

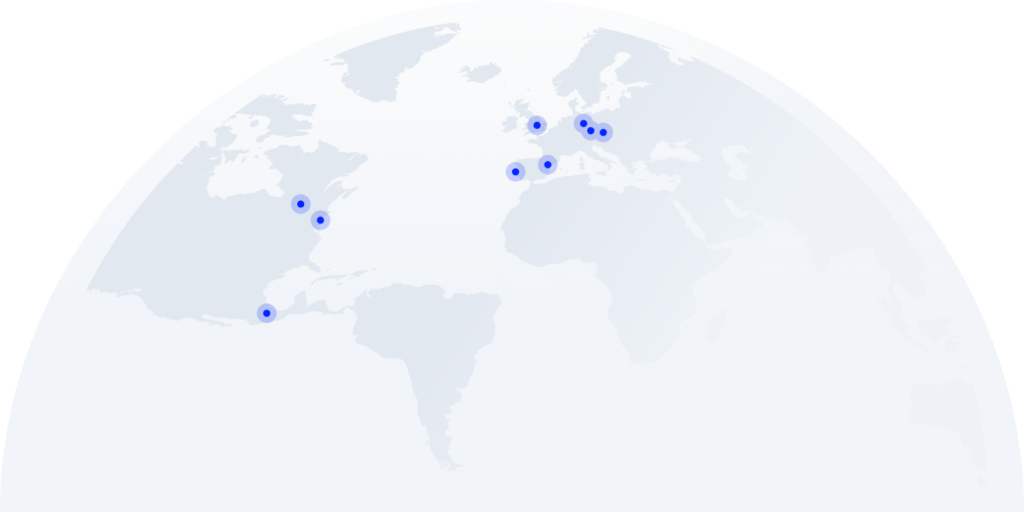

CloudTalk empowers loan officers to streamline their communication processes and boost productivity. With AI-powered features like Smart Dialer, Call Recording, and CRM integrations, it allows officers to reach more potential clients efficiently while ensuring compliance with financial regulations.

Your ability to clearly explain loan packages, interest rates, and payment terms can make or break a deal, but with a solid platform to help you manage your team’s calls, you can rest easy and focus on providing individualized attention to callers.

Just remember, in the end, success isn’t just measured by the number of calls you make, but by the quality of the relationships you build, the loans you close, and the dreams you help realize.

Source:

Take cold calls to the next level: Try CloudTalk!