Get AI Voice Agent for Insurance: Stay Available 24/7 & Never Miss a Renewal

Modern insurance teams can’t afford missed calls, lapsed policies, or poor follow-up. CloudTalk’s AI Voice Agent is your always-on insurance assistant—answering questions, reminding clients, confirming coverage, and reducing churn. It works 24/7, handles inbound and outbound communication, and scales with your business—no extra headcount needed.

AI Voice Agents

Drop a number and Riley from PromptReach will call to confirm interest or consent.

Drop a number and Avery from EnrollIQ will check fit, goals, and eligibility.

Drop a number and Casey from FinPrompt will call to confirm payment status or offer support.

Drop a number and Jordan from CareBridge will call to check care needs, coverage, and eligibility.

Drop a number and Taylor from CoverPath will call to confirm interest, needs, and eligibility.

Drop a number and Quinn from LegalEcho will notify users of updated terms and capture verbal acceptance.

Drop a number and Drew from LegalEcho will assess legal needs and route high-priority cases to the right expert.

Drop a number and Jamie from HireSignal will call to collect feedback after interviews or placements.

Drop a number and Skyler from HireSignal will call to check location, experience, and job expectations.

Drop a number and Morgan from StackNotify will call to confirm a required action or update.

Drop a number and Logan from StackNotify will call to confirm renewal intent or next steps.

Drop a number and Morgan from StackNotify will call to capture CSAT after a resolved ticket.

Drop a number and Parker from StackNotify will call to collect NPS or onboarding feedback.

Drop a number and Blake from StackNotify will call to qualify a demo or trial request and assess intent.

“I never miss a lead, never forget a renewal, and always say the right thing”—Your Insurance AI Voice Agent

Clients expect fast answers, helpful reminders, and clear communication—whenever they reach out. But most insurance teams are stretched thin. Calls get missed, renewals slip through, and urgent changes go unaddressed. That’s why modern insurers use CloudTalk’s AI-powered Voice Agents to manage both inbound and outbound communication—reliably, consistently, and around the clock.

Never Miss a Renewal or Required Follow-Up Again

CeTe, your AI voice agent for insurance companies, handles the recurring tasks that drain your team’s time—like renewal reminders, requalification, and routine Q&A. This matters because every policy you retain is revenue-protected.

Whether it’s sending renewal notices, qualifying new inbound leads, capturing consent for policy updates, or chasing missing onboarding info—your voice agent keeps your pipeline warm, your workload light, and your customers engaged at every step.

AI Voice Agents

Sales Reminder

Agent

Client

Sales / Marketing

Course Inquiry

Agent

Client

Education / EdTech

Payment Reminder

Agent

Client

Financial Services

Healthcare Intake

Agent

Client

Healthcare

Insurance Intake

Agent

Client

Insurance

T&C Acceptance

Agent

Client

Legal Services

Legal Intake

Agent

Client

Legal Services

Candidate Feedback

Agent

Client

Recruitment / HR

Applicant Pre-screen

Agent

Client

Recruitment / HR

Action Reminder

Agent

Client

SaaS / Software & Apps

Subscription Renewal

Agent

Client

SaaS / Software & Apps

CX Feedback

Agent

Client

SaaS / Software & Apps

Post-Sales Feedback

Agent

Client

SaaS / Software & Apps

Trial Signup

Qualifier

Client

SaaS / Software & Apps

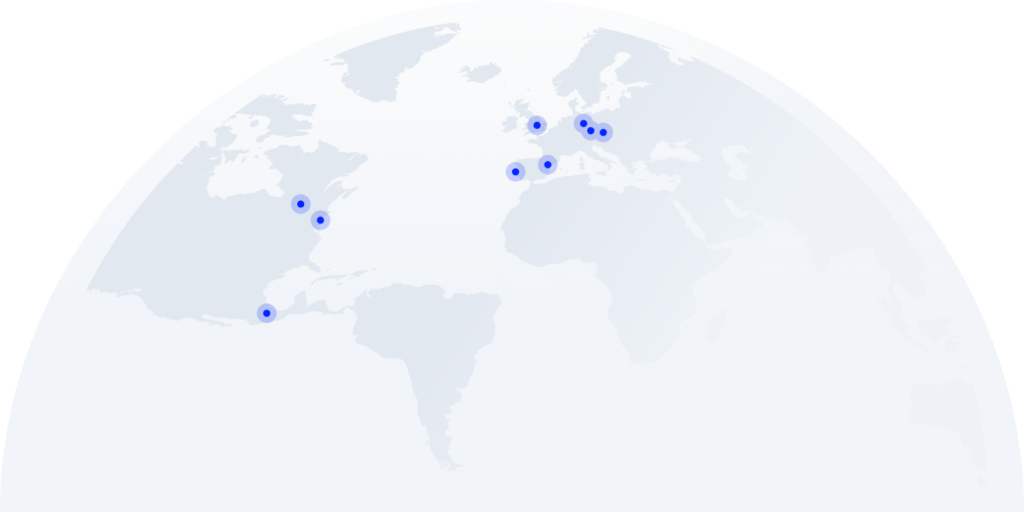

Voice AI That Scales as Fast as Your Insurance Business

As your book of business grows, your insurance call automation assistant helps you handle more communication—without hiring more reps. This is critical for SMB-like insurance agencies, where scaling usually means rising costs—unless you automate smart.

Whether you’re expanding into new regions or supporting clients locally, CeTe adapts fast. It supports high call volumes (hundreds per hour), works across time zones, and enables toll-free or local numbers with matching caller ID—boosting pick-up rates and trust. Grow from anywhere, reach anywhere—no on-prem setup needed.

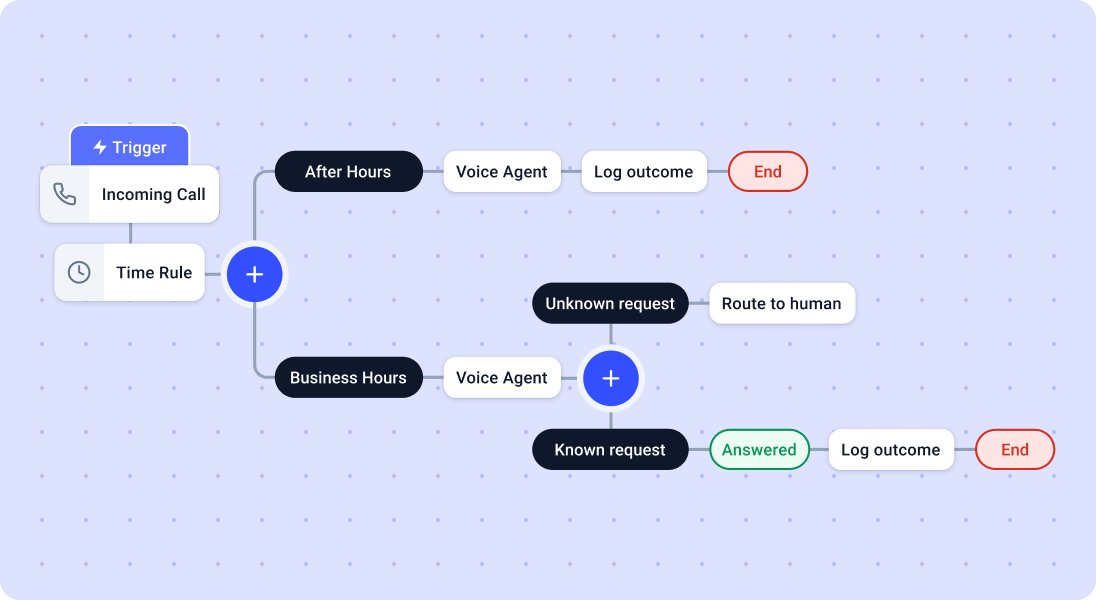

How to Set up Your Insurance AI Voice Agent?

Setting up your AI insurance assistant takes just a few minutes—no code, no IT tickets, no long onboarding.

- Log in to your CloudTalk dashboard and open the “Voice Agent” tab

- Click “Create New Agent” and select your use case—like answering inbound policy inquiries, sending renewal reminders, or following up on missing documents

- Use the drag-and-drop builder to define call flows: how your agent should respond, route, or engage with clients

- Assign a phone number & connect your existing tools (e.g., CRM, calendar, or your claims management workflow)

- Preview and test your agent, then activate—it’s ready to handle calls from day one

Productivity for Insurance Teams

AI-Powered Call Center Built for Insurance Teams That Run 24/7

Give your agents the tools to automate routine calls, reduce manual admin, and stay focused on what matters—serving clients. With CloudTalk’s AI voice agent for insurance call centers, you handle more interactions without burnout, across every stage of the policyholder journey.

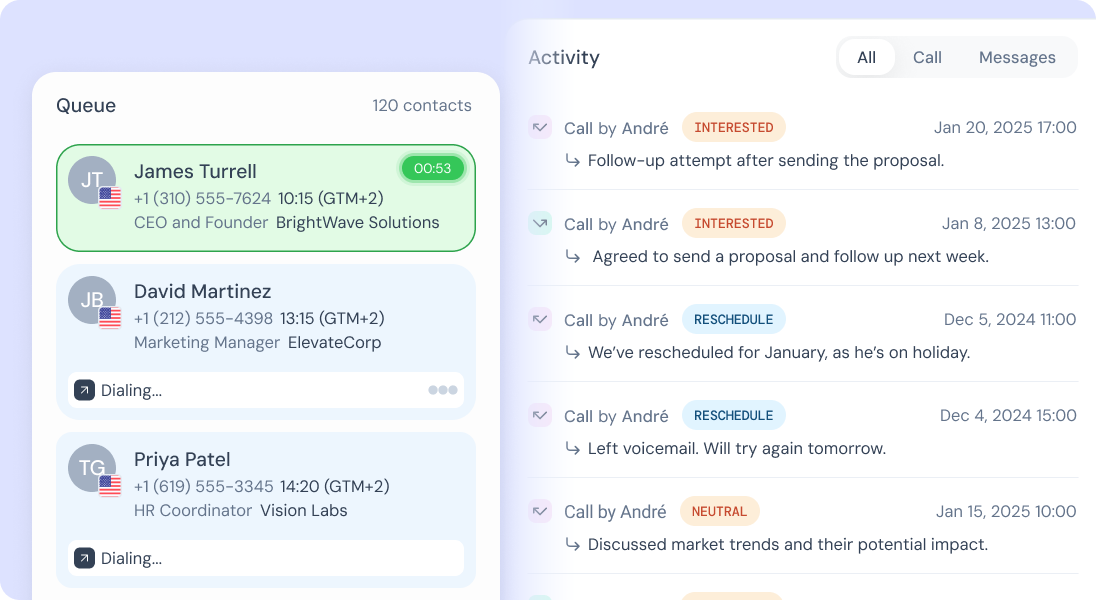

Smarter Outbound Calls

Dial less. Reach 10X more clients.

Follow up on upcoming renewals, missing documents, or overdue payments—faster. CloudTalk’s AI Dialer, voicemail detection (available in Parallel Dialing mode), and insurance AI voice agents help your team talk to 10X more clients and spend less time clicking through lists.

Responsive Inbound Support

Every call gets answered. No waiting.

From claims updates to billing inquiries, every call gets routed where it should—or answered automatically. Smart routing, call queues, and voice agents for insurance make sure no caller gets left behind, even during peak hours or staff gaps.

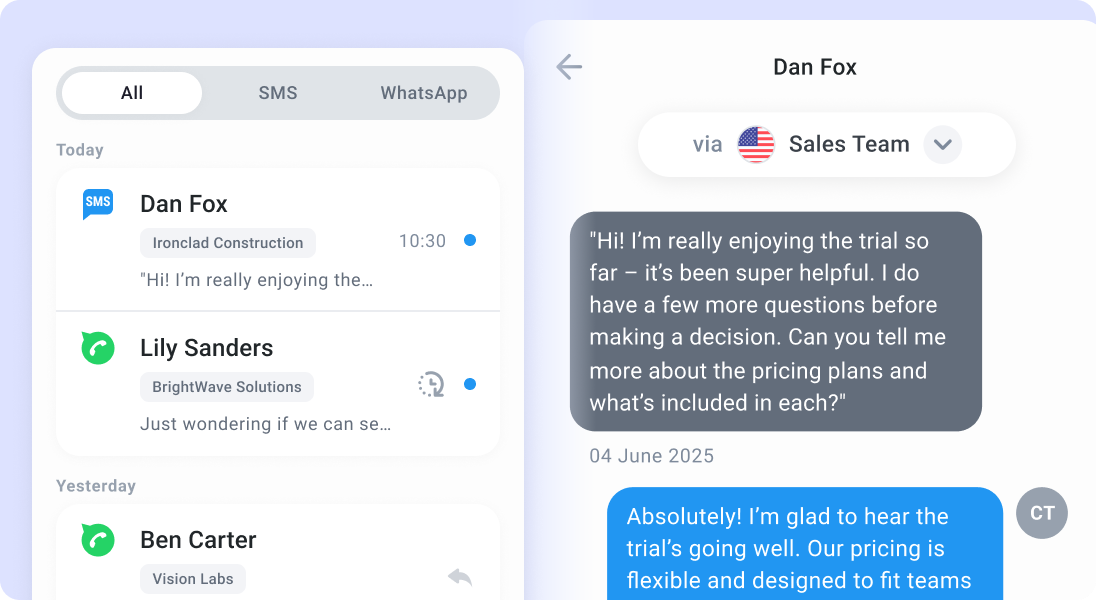

Integrated Messaging & Follow-Up

No answer? No problem.

Follow up on missed calls, send payment reminders, or share renewal links—without picking up the phone. CloudTalk’s SMS and WhatsApp messaging, powered by your insurance voice AI, helps your team stay connected and compliant while reducing churn.

“Thanks to CloudTalk, we cut handle time by 33% and scaled to 6,000 daily calls without adding agents. It’s been a game-changer for how we handle high call volumes.”

Catch Creation, E-Commerce Brand

66%

More capacity without hiring

33%

Reduction in handle time

Only Pay for What You Use

Launch for just €0.25/min. When you’re ready for more volume and more calls, we’ll tailor the pricing to match.

CeTe Voice Agent

€0.25 / min

Increase call volume

Contains

- Full control over final spending

- Unlimited number of Voice Agents

- Can handle 1 call at a time

- English language only

- Choice of all available LLMs

- Choice of all voices (Deepgram/ElevenLabs)

Custom Agent

Contact us for tailor-made offer

Contains

- Custom concurrent calls tailored to your volume needs

- Volume-based pricing discounts (as low as $0.10 per minute)

- Custom packages tailored to your needs

- Premium private Slack channel with dedicated support team

Information

*Includes everything from CeTe Agent

Industry

All

Any

E-commerce

Education/EdTech

Finance

FinTech/FinServ

Healthcare

Home Services

HR Services

Insurance

Legal

Legal Services

Logistics

Managed Services & IT

Real Estate

Recruitment

Restaurants

Retail

SaaS / Software & Apps

Staffing

Telecom/Utilities

Travel & Hospitality

Call Direction

All

Inbound

Outbound

AI Voice Agent for Insurance—Everything You Need to Know

1. AI Voice Agent for Insurance: What It Is and Why It Matters

Definition of AI Voice Agents for Insurance

An AI voice agent for insurance is a virtual assistant that answers customer calls, understands natural language, and automates tasks like quoting, renewal reminders, claim follow-ups, and call routing—without human reps. CloudTalk’s CeTe handles all of this in multiple languages, 24/7.

Importance of AI Voice Agents for Insurance

Insurance AI voice agents reduce admin overload, prevent missed opportunities, and improve customer experience. By automating tasks like policy renewals, quote delivery, and post-claim follow-ups, they cut costs, speed up response times, and help agencies deliver consistent service at any scale.

2. How AI Voice Agents Work in Insurance

AI voice agents like CloudTalk’s CeTe combine real-time speech recognition, intelligent automation, and seamless integration to manage insurance calls from end to end.

Speech Recognition

- Converts spoken phrases like “I want to renew my policy” into structured text in real time

- Handles varied accents and background noise

- Allows the system to instantly process and act on client requests

Natural Language Understanding (NLU)

- Identifies intent (e.g. quote, renew, file a claim, ask about coverage)

- Understands different phrasings (“Where’s my claim?” vs. “What’s the status of my reimbursement?”)

- Continuously improves using real insurance call data

Multilingual Handling and Human-Like Interaction

- Supports multiple languages for diverse client bases

- Adjusts tone and pace to sound natural and empathetic

- Builds trust through contextual, human-like responses

System Integrations for Insurance

- Connects with CRMs, calendars, and third-party tools via Zapier or Make

- Keeps call context and customer intent synced across calls and follow-ups

- Enables smooth handoff to live agents when needed

3. Main Benefits of AI Voice Agents for Insurance

AI voice agents help insurance teams reduce overhead, stay available 24/7, and deliver faster, more reliable communication at every stage of the policyholder journey.

Cost Savings and Efficiency Gains

Voice agents reduce the burden on front-line teams by automating routine calls. That boosts productivity and lowers operational costs.

- Handles renewals, quote delivery, and FAQs automatically

- Reduces manual effort during seasonal spikes

- Delivers consistent, error-free communication

24/7 Availability and Scalability

Clients expect support anytime—not just 9–5. This AI answering service for insurance keeps your insurance lines open without overloading your staff.

- Answers inbound calls and follows up on missed ones

- Scales instantly without adding agents

- Works evenings, weekends, and holidays

Improved Client Experience

Speed and clarity help clients feel supported and confident in their provider, rapidly improving their experience.

- Provides quick answers to policy questions

- Sends timely follow-ups for quotes, renewals, or claims

- Supports multiple languages

Data-Driven Insights and Optimization

Every call is a learning opportunity. Your voice AI for insurance turns interactions into improvements.

- Tracks common objections, drop-offs, and follow-up success

- Helps optimize sales and support workflows

- Surfaces trends for strategic planning

4. How Can I Use AI in My Insurance Agency?

AI voice agents streamline both inbound and outbound communication. Whether you’re managing policy sales or servicing existing clients, CeTe keeps conversations flowing.

- Inbound: Handle quote requests, renewals, claim questions, and coverage FAQs

- Outbound: Send reminders, follow up on pending claims, re-engage lapsed customers

- Missed Calls: Follow up automatically via SMS or callback flow

- Live Support: Escalate complex cases to your licensed agents seamlessly

5. Core Features of AI Voice Agents for Insurance

Built for performance, insurance voice agents combine NLP, automation, and personalization to help insurance teams drive better client engagement—without the manual effort.

Personalization Through Data

- Customizes messages based on previous interactions, policy type, or customer status

- Sends reminders with context (e.g. “Your auto policy is due next week”)

Natural Tone and Empathetic Voice

- Speaks clearly, professionally, and naturally

- Builds trust with consistent, human-like tone

Real-Time Automation and Updates

- Delivers reminders, renewals, or quote status in real time

- Adjusts flow based on client response (e.g., sends doc links if requested)

Omnichannel and CRM Integration

- Syncs with CRMs like HubSpot, Pipedrive, or Salesforce

- Triggers follow-ups via SMS or WhatsApp if calls are missed or ignored

6. How to Implement Your AI Voice Agent for Insurance with Confidence

Rolling out automated voice agents for insurance doesn’t need to be complex. With the right steps, your team can start seeing results in days, not months.

1. Define the Use Case First

Pick one use-case-specific task like renewals, missed call follow-up, or quote delivery.

- Start with the top pain point, such as answering common insurance-related questions

- Expand once it’s trained and delivering results

A clear scope ensures your AI delivers real value from day one.

2. Choose the Right Tech Stack

You need an AI provider built for communication-heavy industries.

- Choose a platform offering crystal-clear call quality

- Look for strong speech recognition and reliable NLU

- Ensure multilingual and accessibility support

3. Build Call Flows Thoughtfully

Use real-world phrasing and logical flows to guide interactions.

- Design fallback options and escalation paths

- Keep it simple for clients of all ages

4. Integrate with What You Already Use

No need to overhaul your stack.

- Sync with your CRM or workflows using native integrations or Zapier

- Make sure call data and follow-up actions stay connected

7. AI Voice Agent Pricing for Insurance Providers

Voice agent pricing depends on volume, features, and how often you use your voice agent. CloudTalk’s voice AI is ideal for fast-scaling insurance businesses—whether you’re solo or run a growing team.

Subscription vs. Usage-Based Models

- Flat-rate: Predictable monthly costs—ideal for high-volume teams & agencies

- Usage-based: Pay as you go ($0.25/min), great for seasonal or part-time use

- Hybrid: Mix predictability with flexibility

Watch for Hidden Costs

- Check for extra fees on call volume, recording, or integrations

- Ask if support and onboarding are included

- Make sure pricing scales cleanly across locations

- Want to avoid hidden costs? Then choose CloudTalk, offering transparent and predictable pricing

How to Measure ROI

- Compare against the current staff time spent on routine calls

- Track renewal conversions, drop-offs, and follow-up rates

- Factor in client satisfaction, retention metrics, and team efficiency

8. Best Practices for Insurance AI Voice Agents

Maximize the value of your AI voice agent with real-world data, ongoing training, and a clear handoff strategy.

- Start with one problem—like rescheduling appointments

- Use real client language to train the system

- Set clear handoff rules for your teams

- Track performance and continuously optimize

- Align with your sales or servicing workflows so agents add real value

9. How to Choose the Right AI Voice Agent for Insurance

The best AI voice agent for insurance balances reliability, flexibility, and real-world value. Look for:

- Easy setup and no-code workflow builder

- Natural-sounding voice and multilingual support

- Seamless CRM integration and powerful analytics

- Support for both inbound and outbound workflows

CeTe, CloudTalk’s AI voice agent for insurance agents, delivers all of the above, making it the most complete voice AI solution for modern insurance teams.

Frequently Asked Questions

About AI Voice Agents for Insurance

How does CloudTalk compare to other AI voice agent platforms?

CloudTalk ranks among the best AI voice agents for SMBs, offering simple setup, CRM sync, and deep workflow customization. Compared to JustCall AI voice agents, CloudTalk’s solution also supports outbound calls.

What are the key features of CloudTalk’s AI voice agent?

Key features of CloudTalk voice agent include real-time transcription, smart routing, CRM integration, multilingual support, no-code setup, and custom personas.

What is CloudTalk’s AI voice agent?

CloudTalk’s AI voice agent is an AI call handling solution that automates support, lead qualification, and bookings.

Does CloudTalk offer a free trial for its AI voice agent?

Yes, CloudTalk offers a 14-day free trial to test AI voice agents without commitment.

We already have a support team—why add CloudTalk AI voice agents?

CloudTalk AI automates repetitive calls, so your team can focus on complex, high-value cases.

Is CloudTalk’s AI voice agent secure and compliant?

Yes, CloudTalk AI voice agent is secure and compliant with encryption, GDPR, and HIPAA support for regulated industries.

Can I customize CloudTalk AI voice agents for my workflows?

Yes, you can fully customize AI voice agent call flows, scripts, voices, and logic—no coding required.

Can CloudTalk AI voice agents integrate with our current tools?

Yes, CloudTalk’s voice agent seamlessly integrates with Salesforce, HubSpot, Zoho, and many other CRM, helpdesk, or ATS tools.

How quickly can we get started with CloudTalk AI voice agents?

You can launch CloudTalk voice agents in minutes, right from your dashboard—no lengthy install.

What if CloudTalk’s AI voice agent says something off-brand?

Strict prompts, scripts, and oversight prevent off-brand replies; easy edits keep agents on message.

What happens if CloudTalk’s AI voice agent gets stuck?

The agent can auto-escalate or transfer stuck or complex calls to a live human agent.

Can CloudTalk AI voice agents filter spam calls or voicemails?

Yes, CloudTalk detects, blocks, and filters spam calls and voicemails automatically.

Will I need technical help to use CloudTalk AI voice agents?

No, no tech help is needed. It’s no-code design lets anyone build, launch, or manage agents via drag-and-drop.

Ready to Put Your Team to the Test?

Can AI do it better? Try a free call and find out.