10 Best Auto Dialers for Insurance Agents in 2026

Manual dialing eats away at an insurance agent’s most valuable asset—time.

When each lead costs $30–$1001, watching potential clients slip away due to inefficient outreach isn’t just frustrating—it’s costly for your bottom line.

The right auto dialer can change the game—powering 300% more calls, instant lead follow-up, fewer errors, and smarter workflows through CRM automation and real-time analytics. It’s the shift from chasing leads to running a predictable, scalable sales machine.

In this guide, we’ll cover the best auto dialing modes, must-have features for compliance and efficiency, and the best auto dialer providers that provide a mix of speed, personalization, and ROI—so you can close more policies with less effort.

Key takeaways:

- To find the best fit, consider each provider’s features, pricing, and user reviews. Many offer free trials, so you can test the platform before committing.

- Auto dialers automate the dialing process, enabling agents to focus more on building client relationships and closing deals rather than wasting time on manual tasks.

- From Power Dialers to Predictive and Progressive options, each dialer type offers unique benefits, such as handling high call volumes or providing personalized engagement.

- Modern auto-dialers deliver insurance-specific features such as visual workflow designers, AI-powered assistance, local presence dialing, compliance controls, and CRM integration.

- The right auto-dialer transforms insurance sales beyond automation—helping agencies scale efficiently while retaining personalized, compliant client outreach.

Connect with our experts and learn how we’ll help you ramp up your dialing game.

What is a Dialer for Insurance Agents?

A dialer for insurance agents is an auto-dialer software that streamlines outbound calling while integrating with policy management and CRM systems.

Instead of manually punching in numbers, agents move seamlessly from one live conversation to the next—boosting call volume by up to 300%.

Beyond speed, it equips agents with real-time client data such as policy details, renewal dates, and past interactions.

This ensures every call is compliant, personalized, and focused on moving the client toward a quote, renewal, or upsell—whether you’re handling new leads or servicing existing policyholders.See for yourself how auto dialer software works in the short video below.

Why Do Insurance Agents Need an Auto Dialer?

Insurance agents juggle constant follow-ups, renewals, and new lead calls—often at the cost of valuable selling time. An AI dialer automates repetitive tasks like dialing, call logging, and scheduling follow-ups, allowing agents to focus on building client relationships and closing more policies.

Key benefits for insurance agents:

- Maximize productivity: Move seamlessly between calls without manual dialing.

- Simplify renewals: Automate reminders and follow-ups to keep policies active.

- Close more deals: Prioritize and connect with high-value leads faster.

- Personalize calls: Access policy details and history before every conversation.

- Cut admin time: Auto-log calls and notes directly into your CRM.

- Stay compliant: Built-in tools handle DNC checks, call recording, and time restrictions.

The right auto-dialer can triple talk time, speed up lead follow-up, reduce errors, and provide actionable analytics—directly impacting your agency’s revenue.

Test drive the best Auto Dialer in the market. First 14 days are on us!

What Types of Auto Dialers Can Insurance Agents Use?

Insurance agents can choose from several auto dialing modes, each designed to meet specific needs and goals. While all of these can fall under the broader category of power dialers, their unique features make them suited for different strategies:

1. Preview Dialer

A Preview Dialer gives agents valuable prep time by displaying contact details before each call. This makes preview dialers ideal for high-value, medium-volume campaigns where personalization is key.

2. Power Dialer

The Power Dialer automatically dials the next number when an agent signals readiness, striking an optimal balance between efficiency and call control.

This dialing mode helps maintain high connection rates while ensuring quality conversations. Power dialers are best for medium-volume sales teams and help agents connect with prospects faster, but they don’t allow time between calls.

3. Progressive Dialer

The Progressive Dialer works very similarly to the power dialing mode. It also dials a list of contacts in sequence, but only moves to the next number on the list when reps are ready, giving them a bit more breathing room than power dialers.

Progressive dialing is best for insurance teams focusing on quality lead interactions rather than pure call volume.

4. Parallel Dialer

The Parallel Dialer dials up to 10 numbers at once, detects answering machines, and connects the agent to the first person who answers, automatically ending other call attempts.

This mode is ideal for insurance teams seeking to maximize outreach efficiency while maintaining full control over their calling campaigns.

It replaces Predctive Dialers that also speed up the outbound, but often result in dropped calls and compliance issues. This mode is ideal for insurance teams seeking to maximize outreach efficiency while maintaining full control over their calling campaigns.

Top 10 Auto Dialer Options for Insurance Agents

Before diving into detailed reviews, here’s a quick comparison of the top auto dialer solutions for insurance teams:

Feature

Description

Dialers

Pricing

VoIP-based insurance call center software with IVR, call analytics, and seamless CRM integrations.

Power, Parallel, Progressive & Preview Dialer

$49/user/month

Parallel Dialing available as add-on for $39/user/month

User-friendly call center with CRM integrations and call monitoring.

Power Dialer

$50/user/month (3-user min)

Cloud contact center with SMS, CRM integrations, AI assistance.

Power & Predictive Dialer

$49/user/month

Sales engagement platform with CRM-integrated Power Dialer and messaging.

Power Dialer

$99/user/month

Power dialer for high efficiency with voicemail drop and CRM integration.

Power Dialer

$140/user/month

Unified communications with AI transcription and omnichannel.

Power, Predictive, Progressive & Preview Dialer

$35/user/month

Enterprise-grade contact center with advanced dialing and workforce tools.

Power, Predictive, Progressive & Preview Dialer

~$175/user/month

AI-powered unified communications platform with voice intelligence.

Power & Progressive Dialer

~$15–25/user/month

Compliance-focused omnichannel platform with predictive dialing.

Predictive Dialer

~$71–110/user/month

1. CloudTalk

CloudTalk is a cloud-based call center software built to make life easier for insurance agents. It automates repetitive tasks and streamlines communication, so you can spend less time on busy work and more time building client relationships and closing deals.

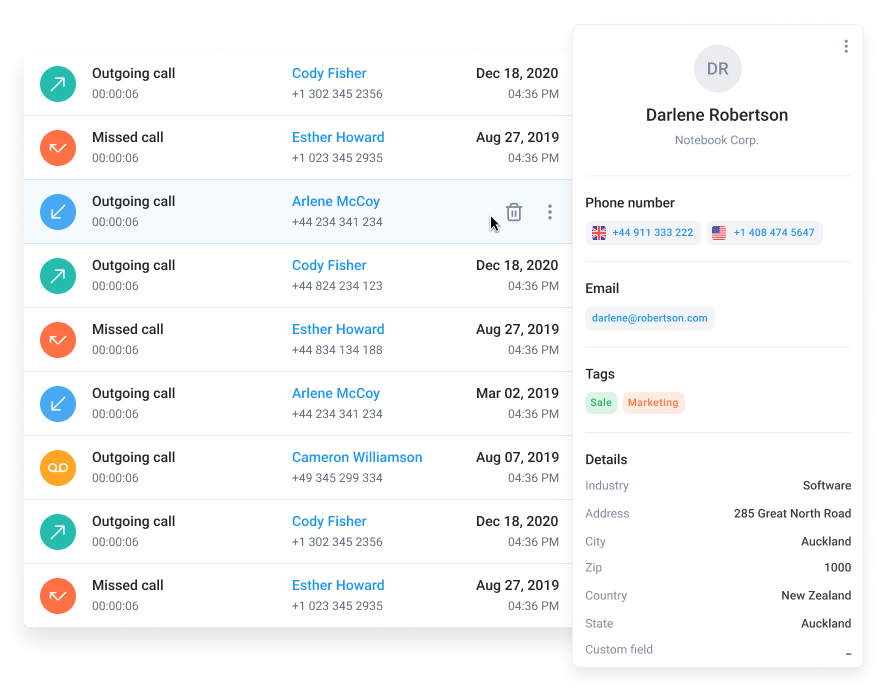

CloudTalk stands out with its crystal-clear call quality, seamless integrations with tools like HubSpot and Zendesk, and a user-friendly interface. It keeps you organized, helps you personalize every interaction, and cuts down on time-consuming admin tasks.

Whether you’re managing policies, processing claims, or keeping up with renewals, CloudTalk takes the hassle out of your daily operations. Its intuitive tools and effortless workflows free you up to focus on delivering the exceptional service your clients deserve.

Key Features:

- 35+ integrations, including HubSpot, Salesforce, Zendesk, and Zoho, mean personalized client interactions.

- Skill-Based Routing routes calls automatically to the right agent or department for reduced client wait times.

- 3-Way Calling lets you listen in on calls or invite other agents to help out with complex issues.

- Interactive Voice Response leads clients where they need to be to cut down on wait times.

Pricing:

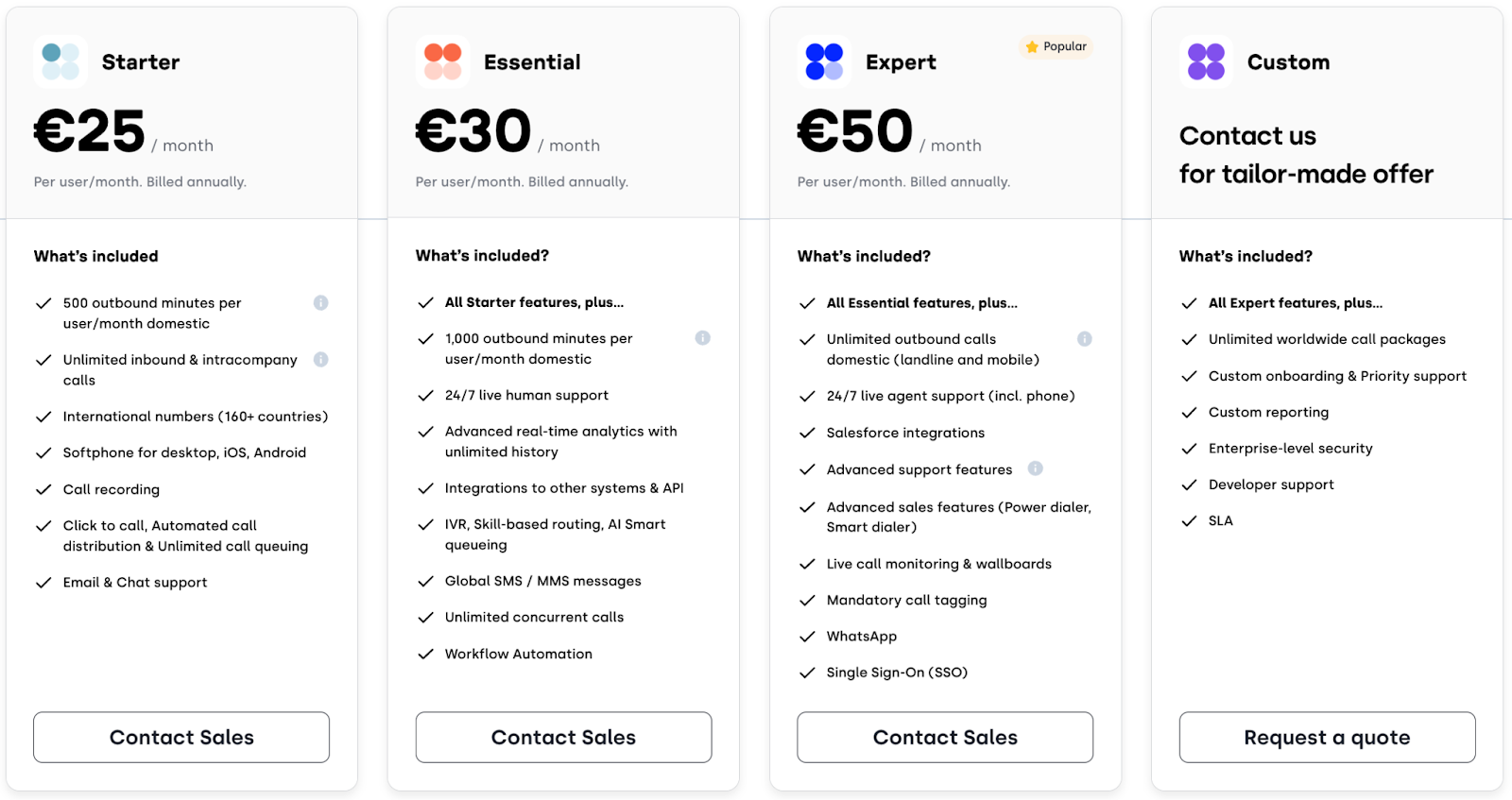

CloudTalk offers four pricing plans, depending on the features you need:

- Starter (€25/user/month): Ideal for small teams needing essential call management tools like unlimited inbound calls, call recording, and ACD.

- Essential (€30/user/month): Best for growing businesses with SMS/MMS, IVR, skill-based routing, and CRM integrations for streamlined workflows.

- Expert (€50/user/month): Designed for high-volume teams, offering advanced dialing, live call monitoring, and unlimited outbound calls.

- Custom (Contact for pricing): Tailored for enterprises requiring global scalability, custom reporting, and dedicated support.

2. Aircall

Aircall is designed to enhance team communication and streamline customer interactions. While it provides many valuable tools for businesses, insurance agents may find some limitations when compared to other companies.

Key Features:

- CRM integrations, including HubSpot, Salesforce, and Zoho, give access to client details during calls.

- Call tagging helps organize workflows better.

- Click-to-dial saves time by directly dialing from CRMs

- Call monitoring lets managers provide real-time coaching for agents.

Pricing:

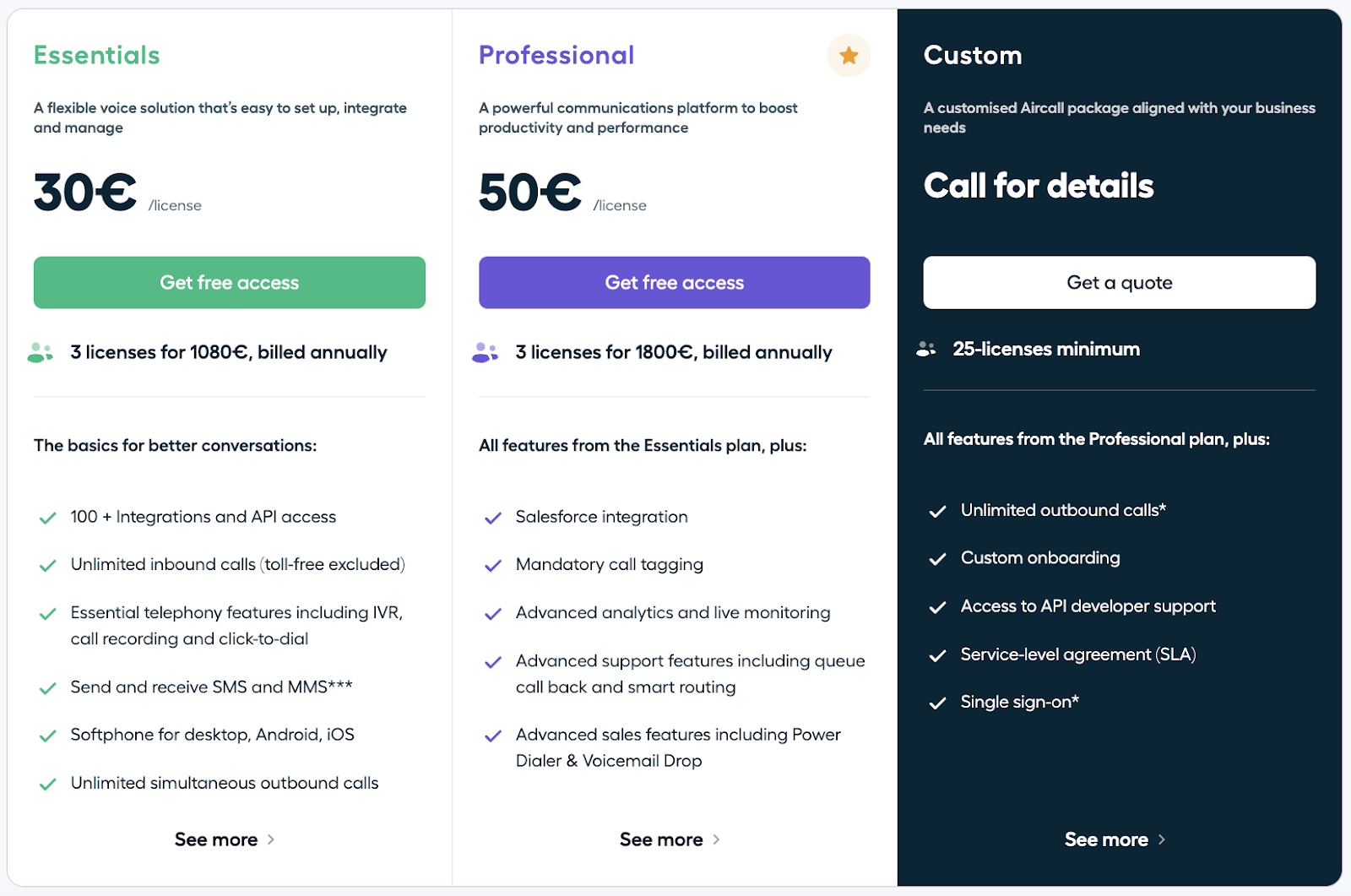

Aircall offers three pricing tiers:

- Essentials ($30/user/month): Includes basic features like unlimited inbound calls, click-to-dial, call tagging, and integrations.

- Professional ($50/user/month): Adds advanced analytics, Salesforce integration, and call monitoring features.

- Custom (Contact for pricing): Tailored for enterprises with specific needs, offering priority support and custom features.

3. Ringover

Ringover enhances team collaboration and streamlines client communications. Its user-friendly interface and robust feature set make it a viable option for insurance agents seeking to improve their customer interactions.

Key Features:

- CRM Integrations let you connect with platforms like Salesforce and HubSpot, allowing agents to access client information during calls.

- Advanced Call Analytics provides detailed insights into call performance, enabling data-driven decisions to optimize client interactions.

- Call Monitoring and Recording lets Managers monitor live calls and access recordings for training and quality assurance purposes.

Pricing:

Ringover offers three pricing plans:

- Smart (€21/user/month): Includes local numbers from 43 countries, mobile and desktop applications, IVR, call forwarding, and call logs with recordings.

- Business (€44/user/month): Adds advanced IVR with smart routing, call queues, two integrations, advanced analytics, and coaching features like call whispering.

- Advanced (€54/user/month): Offers a power dialer, call scripts, voicemail drop, and local presence dialing.

4. JustCall

JustCall is an all-in-one cloud-based phone system designed to automate tedious tasks and enhance productivity for insurance agents. Advanced automation tools and conversational intelligence features allow agents to focus on customer care.

Key Features:

- Extensive integrations with CRMs and business tools for seamless client management.

- Open API for custom workflows and integrations.

- Sales automation tools, including AI-powered call scoring and automated note summarization.

- Omnichannel connectivity with calls, SMS, and WhatsApp, ensuring agents can reach clients on their preferred platform.

- JustCall AI features like real-time live assistance, on-screen scripts, and dynamic dialers for insurance agents that prioritize warm leads.

- International calling and localization tools for global outreach.

- Reporting and analytics to optimize performance and track campaign success.

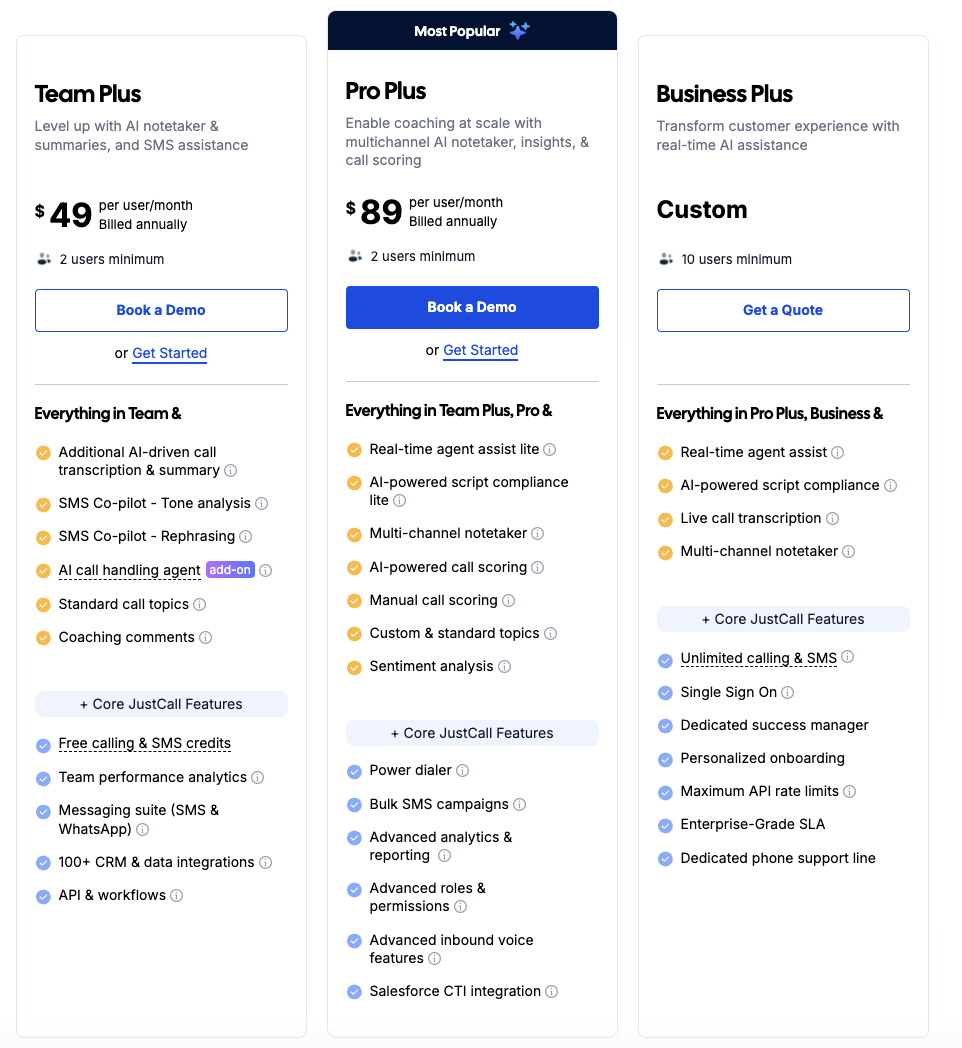

Pricing:

- Team Plus: $49 per user/month

- Pro Plus: $89 per user/month

- Business: Request a quote

5. Kixie

Kixie is a sales engagement platform that enhances outbound calling and texting efforts for sales teams. Its robust features, including a Power Dialer and CRM integrations, aim to streamline communication processes and boost productivity for insurance agents.

Key Features:

- Power Dialer enables agents to call multiple leads simultaneously, increasing outreach efficiency.

- CRM Integrations with platforms like HubSpot, Salesforce, and Zoho allow for seamless synchronization of client data and call activities.

- Call Recording and Monitoring provide tools for quality assurance and training, ensuring consistent client interactions.

- Automated SMS lets agents send personalized text messages, enhancing follow-up capabilities.

Pricing:

- Integrated: $35 per user/month (billed annually)

- Professional: $65 per user/month (billed annually)

- Outbound PowerDialer: $95 per user/month (billed annually)

- Enterprise: Custom pricing available upon request

6. PhoneBurner

PhoneBurner is a cloud-based power dialer designed to enhance productivity for outbound sales teams, including insurance agents. By streamlining the calling process and automating follow-ups, it enables agents to focus more on building client relationships and closing deals.

Key Features:

- Power Dialer allows agents to reach up to 80 contacts per hour, increasing outreach efficiency.

- Voicemail Drop enables leaving pre-recorded messages, saving time during outreach.

- CRM Integration with platforms like Salesforce and HubSpot ensures seamless data management.

- Call Recording facilitates quality assurance and training by recording and analyzing conversations.

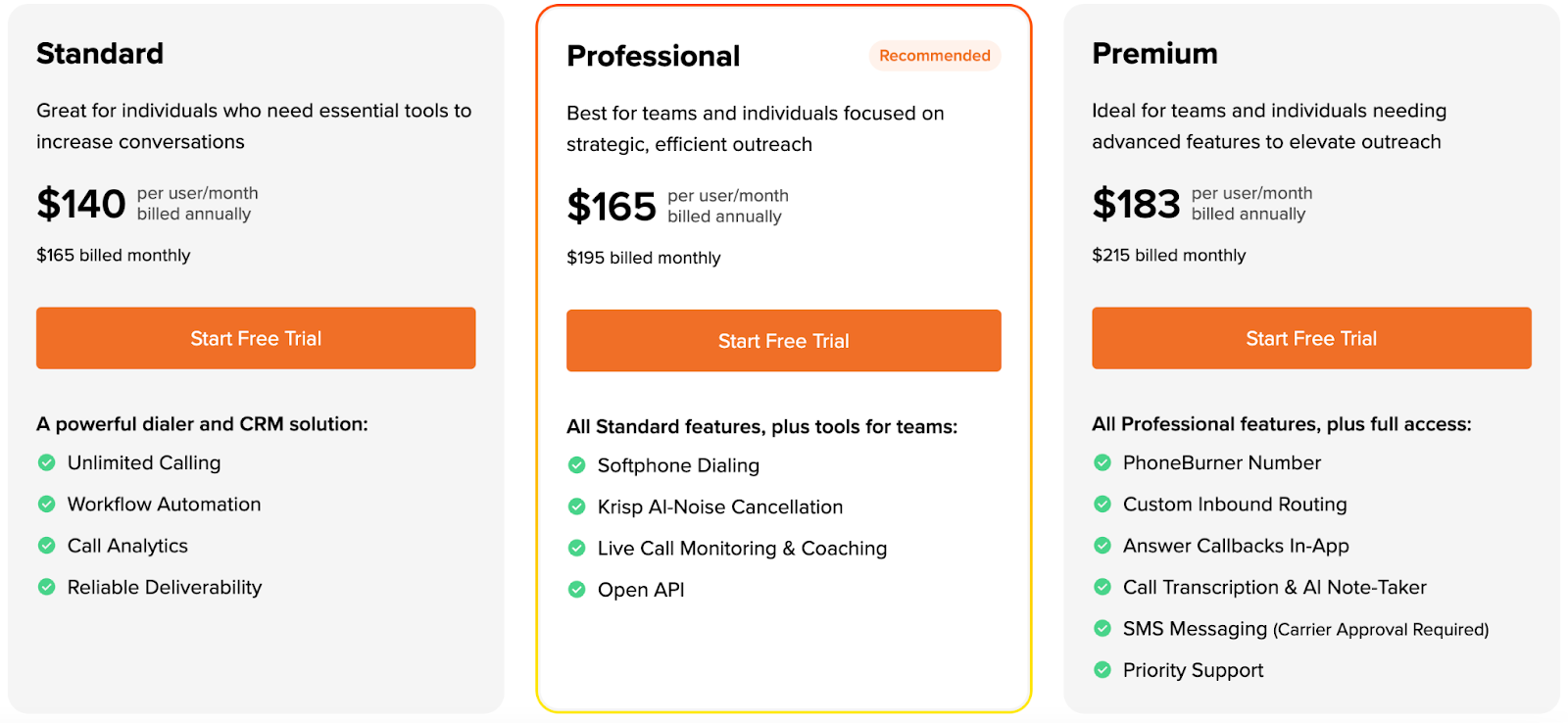

Pricing:

PhoneBurner offers several pricing plans:

- Standard: $149 per user/month, includes unlimited dialing.

- Professional: $195 per user/month, adds advanced features like enhanced reporting and priority support.

- Premium: $215 per user/month, offers the full suite of features, including custom integrations and dedicated account management.

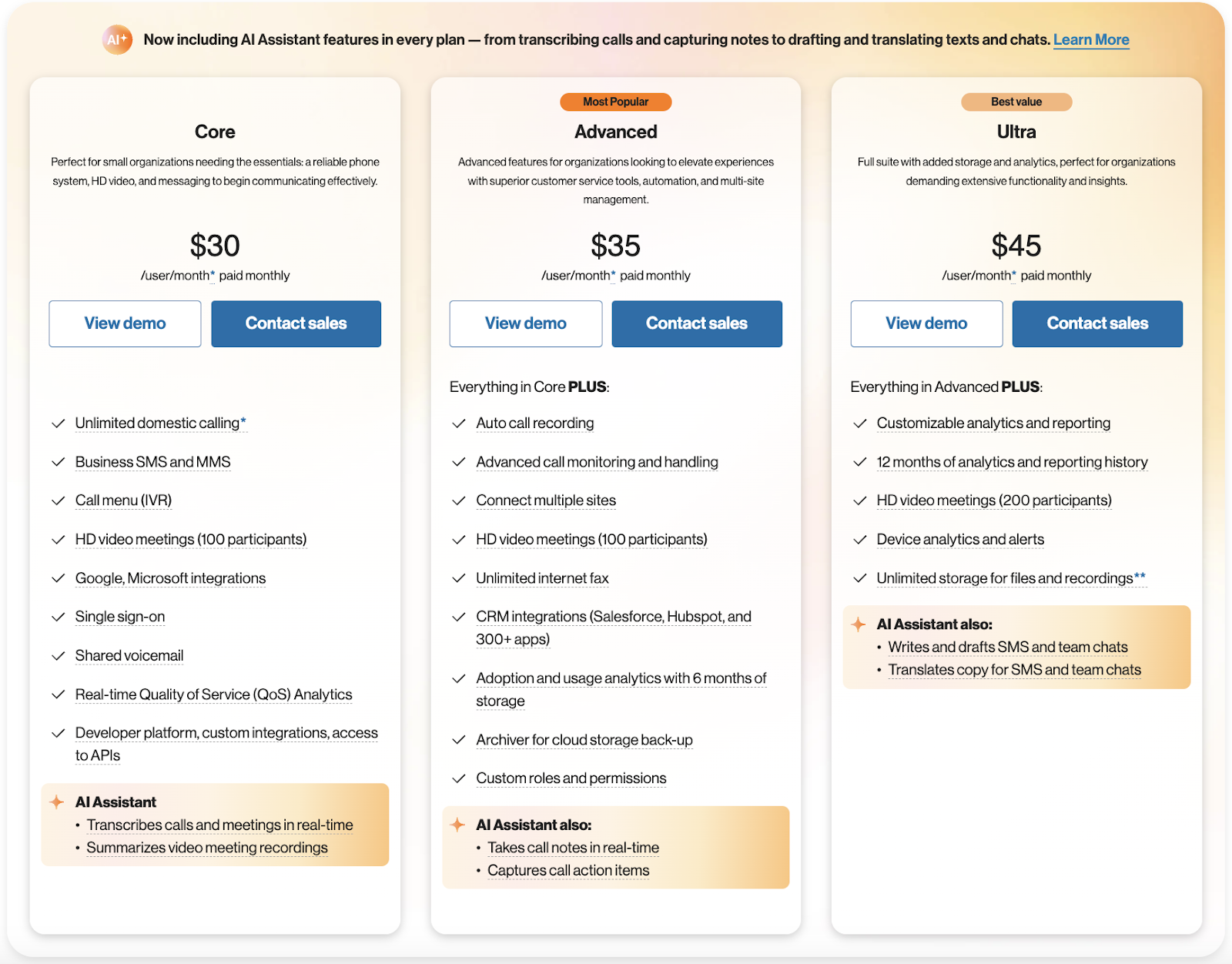

7. RingCentral

RingCentral offers a comprehensive suite of tools including voice, video, messaging, and collaboration capabilities, making it a versatile solution for insurance agents aiming to improve client interactions and streamline workflows.

Key Features:

- Unified Communications: Integrates phone, video meetings, and team messaging into a single platform, facilitating seamless communication.

- Advanced Call Management: Offers features like call forwarding, voicemail-to-email, and auto-attendant to efficiently manage inbound and outbound calls.

- CRM Integrations: Seamlessly connects with popular CRM systems, enabling agents to access client information during calls.

- Analytics and Reporting: Provides detailed insights into communication metrics, assisting in performance evaluation and decision-making.

Pricing:

RingCentral offers several pricing plans to accommodate different business needs:

- Core: $20 per user/month, includes unlimited calls within the U.S. and Canada, business SMS, and team messaging.

- Advanced: $25 per user/month, adds video meetings for up to 100 participants and advanced call handling features.

- Ultra: $35 per user/month, offers video meetings for up to 200 participants, call recording, and real-time analytics.

8. Five9

Five9 provides a mature contact center solution with sophisticated dialing capabilities, ideal for larger insurance operations requiring advanced campaign management.

Key Features:

- AI-driven call routing and distribution

- Comprehensive workforce optimization

- Dynamic scripting capabilities

- Advanced compliance tools

Pricing:

- Starts at $175/user/month for voice only

- Additional costs for advanced features

- Five9 Full Pricing Guide

9. Dialpad

Dialpad combines AI-powered communication tools with cloud flexibility, offering insurance agencies a modern approach to client outreach.

Key Features:

- Real-time AI insights and coaching

- Voice intelligence technology

- Native video and messaging integration

- Automatic call recording and transcription

Pricing:

- Standard: $15/user/month

- Pro: $25/user/month

- Enterprise: Custom pricing

- Dialpad Full Pricing Guide

10. NICE CXone

NICE CXone brings a robust enterprise contact center solution with specialized features for insurance operations, particularly suited for agencies requiring advanced compliance and quality management.

Key Features:

- Patented predictive dialing technology

- Omnichannel campaign management

- AI-powered schedule forecasting

- Advanced compliance controls

Pricing:

- Digital Agent: $71/user/month

- Voice Agent: $94/user/month

- Omnichannel: $110/user/month

- NICE CXone Full Pricing Guide

Key Features Every Insurance Auto Dialer Should Have

As an insurance agent, managing your time and maintaining consistent communication with clients is critical. That’s where a modern insurance agency dialer steps in to automate calls, streamline workflows, and ensure every lead gets the attention it deserves.

Below, we’ll explore the key features that make a dialer essential for insurance agents, helping you stay on top of your game while closing more deals.

1. CRM Integration

Seamless synchronization and integration with customer databases for instant access to policyholder information. When a prospect calls, their history, policy details, and interaction records automatically display for your agents.

2. Call Recording and Analytics

Capture conversations for quality assurance and performance optimization. Turn every call into a learning opportunity, using real interactions to refine your team’s approach and track improvement over time.

3. Voicemail Drop

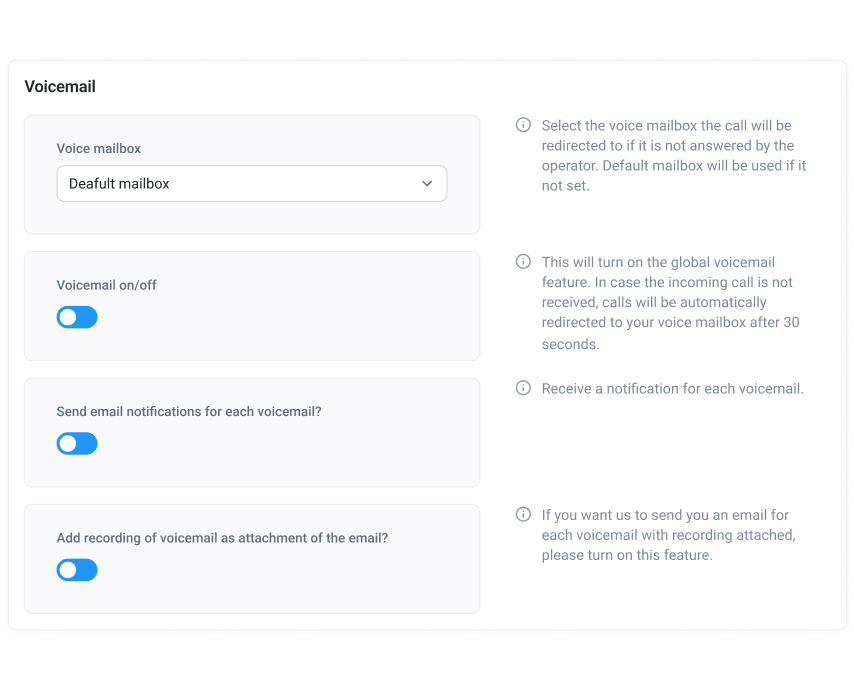

Automatically leave pre-recorded messages when calls go unanswered, saving agent time. Instead of repeating the same voicemail dozens of times daily, your agents can focus on connecting with live prospects.

4. Local Presence Dialing

Display local area codes to increase answer rates. Transform cold calls into warm conversations by presenting familiar area codes that build instant trust with potential clients.

5. Customizable Call Scripts

Provide agents with adaptable scripts for various insurance scenarios. Guide conversations naturally while ensuring key policy details and compliance requirements are consistently covered.

6. Compliance Controls

Ensure adherence to industry regulations. Stay protected with automatic flagging of restricted numbers and built-in calling hour limitations.

7. Multi-Channel Communication

Integrate SMS and email capabilities for follow-ups and appointment scheduling. Meet your clients where they are, creating seamless communication flows that boost engagement rates.

How to Pick the Best Auto Dialer for Insurance Agents

Enhance client engagement, close more deals, and build long-term brand loyalty by choosing a dialer that aligns with the unique workflows and regulatory needs of insurance agencies. Here are the key decision factors—refined and reinforced with industry-best practices and research.

1. The Right Dialing Strategy for Your Workflow

Different dialing modes support different outreach objectives:

- Preview Dialers: display key prospect information before connecting—excellent for selling complex or high-value insurance products.

- Power Dialers: perfect for relationship-centric selling, allowing agents control over pacing and personalization.

- Progressive Dialers: dial only when agents are ready, balancing efficiency and human touch.

- Parallel Dialers: Dial multiple leads at once, skip voicemails, and connect the first person who answers—minimizing agent idle time and boosting connect rates..

Select the mode that supports the balance between productivity and personalization your agency needs.

2. Seamless Integration with Insurance Workflows

Your dialer should:

- Sync effortlessly with your CRM tools and policy admin systems for automatic call logging and context-aware do-not-call (DNC) checks.

- Provide streamlined agent navigation without platform switching—a proven way to maintain personalized outreach at scale.

- CloudTalk’s insurance call center offers real-time integration, conflict-free routing, and auto-logging, dramatically reducing agent admin time—and delivers up to 2.5x outbound success rates and 81.7% higher call volume for insurance clients.

3. Built-in Compliance So You Stay Audit-Ready

Insurance dialing must meet strict regulatory standards:

- Look for automatic DNC list filtering, time-of-day restrictions, call recording, and secure access controls.

- Ensure you can generate audit logs and compliance reports on demand—for TCPA, GDPR, or industry-specific regulations.

- At scale, CloudTalk highlights end-to-end encryption, audit trails, and AI Voice Agents that maintain compliance even during high-volume periods.

4. Scalability Aligned with Agency Growth

Your auto-dialer should support strategic expansion:

- Quick onboarding for new users, flexible auto dialer pricing plans, and 24/7 support help keep pace with agent growth.

- Look for options like CloudTalk’s custom enterprise tiers and AI assistance tools to handle call surges—especially during renewal cycles or claim crises.

5. Maximize Total Value, Not the Lowest Price

When evaluating auto-dialer solutions, don’t get distracted by sticker price alone. Instead, zero in on key ROI metrics that directly tie into performance and growth for insurance agencies:

- Lead response velocity: Faster callbacks dramatically increase your chances of closing deals—especially in a market where timing is everything.

- Efficiency enhancements: Features like voicemail drops, SMS follow-ups, and call disposition workflows reduce busywork, enabling agents to focus on selling.

- Conversion potential: Small boosts in productivity often yield large revenue gains—especially when follow-up is prompt and smooth.

Need a real-world proof? One Florida-based life insurance agency adopted a dialer solution and, in just 60 days, saw 42% more leads contacted within 10 minutes, a 30% uplift in policy conversions, and a 20% reduction in call handling time2.

6. Look for These Value-Adding Features

Beyond dialing, the best auto-dialers for insurers include:

- Omnichannel communication: calls, SMS, and email follow-up in one place.

- Customizable scripts and lead workflows: help agents adapt pitch based on policy type or campaign.

- Local presence dialing: by using familiar area codes, you increase answer rates and build trust.

- Call analytics & agent coaching: real-time dashboards and recordings for performance improvements.

- AI Voice Agents and 24/7 handling: ideal for managing claim intake surges or renewal campaigns.

Test drive an insurance auto dialer offering all features above.

Drive Your Agency Forward with Smart Dialer Choice

Your agency’s growth depends on connection—not just making more calls, but making each one count. By choosing the right dialer, you can elevate every step of your outreach:

- Dial smarter, not harder: Select modes like Preview for personal touch, or Power and Parallel when speed is key.

- Integrate seamlessly: A dialer that works with your CRM and policy platforms removes friction and saves time.

- Stay compliant by design: Built-in DNC filters, call recording, and time restrictions shield you from regulatory risk.

- Scale on your terms: Whether adding agents or running campaigns, your dialer should expand with your pace.

- Turn every call into opportunity: Faster responses, better client engagement, and smoother renewals drive real business results.

Ready to evolve from manual dialing into strategic outreach? Start with CloudTalk Dialer—it delivers powerful automation while preserving the personal touch that helps turn prospects into loyal clients.

Dial our experts who’ll show you how to dial like one too.

Sources: